Like a lot of people in my generation, I have over the years become sort of a pack rat, especially when it comes to old market data—specifically real estate data from here in the Dallas area. I’m not sure it will ever be of any real commercial use, except for maybe in a blog like this.

I was at a recent industry meeting and overheard some young brokers jawboning about how high land prices had gotten in Uptown. They were speculating as to whether or not developers were once again extending themselves too far by overpaying for the dirt (as if that would be a surprise to anyone!) These bright, but rather naïve young brokers had heard of sites trading over the last year in the “$50- to $60-per-square-foot ” range, but now land prices may even be approaching “triple digits—or more!” As if on cue, they voiced “crazy” in confounded, if not astounded, unison.

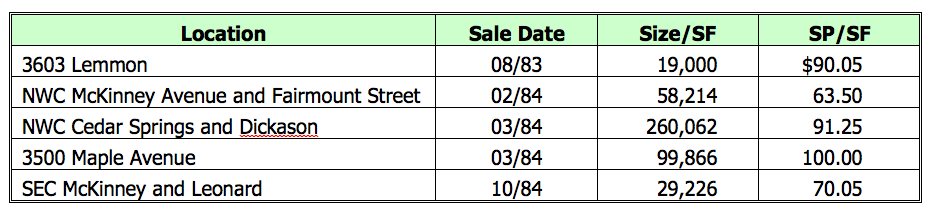

My thought in hearing their comments on these current price levels was that we had finally gotten back to pre-recession pricing for good sites in what we used to call Oak Lawn, the submarket now commonly referred to as Uptown. And that pre-recession pricing, for you young readers, would be in comparison to the recession of 1986, not 2008. Below are a few of the Oak Lawn/Uptown land sales I dug up from my dusty, but trusty, files:

As you can see, pricing in today’s market has come around to where it was when 10-year U.S. Treasury yields were in the 11 percent to 13 percent range (versus the 1.7± percent today). And back then, the population in Dallas-Fort Worth was about 3.4 million (versus the 6.5 million+ today.)

Using these comparisons, today’s pricing looks like a relative bargain, if not a downright steal, especially when compared to those “crazy” prices paid almost 30 years ago. I am just glad I’m here, as this market comes around—again.

Chuck Dannis is co-founder of Crosson Dannis Inc., which provides real estate appraisal and consultation services for many of the nation’s largest real estate lenders and owners. Contact him at [email protected].