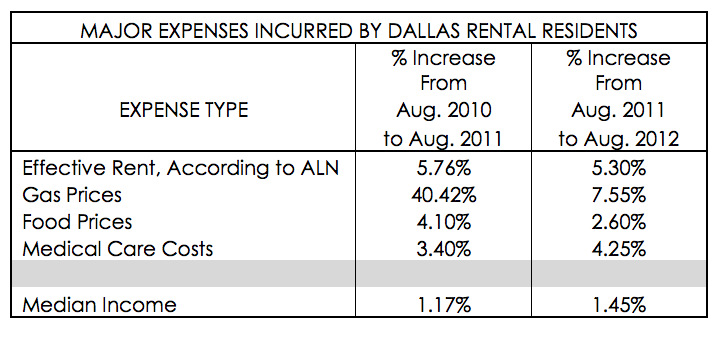

We all hear and read of the rent increases being achieved in the multifamily space. MPF Research recently reported that Dallas registered increases of nearly 5 percent in its midyear annual rent growth study. ALN reports that effective rent increased 5.76 percent from August 2010 to August 2011, and 5.3 percent when comparing August 2011 to August 2012.

At Henry S. Miller Realty Management, we experienced similar results in our Texas portfolio, seeing rents increase 7 percent in 2011 and 6.4 percent when comparing the first seven months of 2011 to the first seven months of 2012.

Although we celebrate the significant increases currently being experienced in our operations, one has to wonder what’s happening with the resident’s ability to continue to absorb these rental increases, given the pressures they’re experiencing in the basic necessities of life, including gas, food, and medical costs.

Here’s how it’s breaking down for Dallas consumers:

As the above table demonstrates, increases in median income have been significantly deficient when compared to the increases consumers are dealing with every day in major household expenses. It has long been an established standard in the multifamily industry that residents qualify to rent an apartment on a 3-to-1 ratio (three dollars of income for every one dollar in rental obligation). Therefore, a resident paying $900 per month in rent would need to make $2,700 in monthly income to qualify to rent the apartment.

Given the rental increases experienced in the Dallas area, a resident who two years ago was paying $900 per month would be paying $1,002 per month today. Assuming that this resident has recognized pay increases consistent with median income improvement, this same resident would be making $2,869 per month. In order for this resident to re-qualify to rent their apartment they would need to make $3,006. Therefore, they would be $137 short of qualifying for their rent or be qualifying on less than a 3-to-1 ratio. This $137 monthly shortfall is for rent only and does not contemplate increases in typical living costs.

Although some of the published reports say that rental increases have slowed modestly in the past few months, it still remains that basic costs of living are increasing at a significantly higher rate than individual income. The question remains: What are residents to do? Are they going to be able to continue to absorb rental increases, be required to move into cheaper housing, tighten their belt a little tighter, or find a second job? It seems that individuals and families will each have to find a way to deal with this conundrum in different ways.