Editor’s Note: In our January 2009 issue, we published an article by Marty Cortland titled “A Realist’s View of the Market: Aaarrgh!” In it, Cortland, a writer with no credentials other than he’d started a small, very successful hedge fund, offered some advice for surviving the economic meltdown. First, he suggested you keep your job. Second, he suggested you sell enough stock so that you could pay off all your credit card debt and have at least six months worth of living expenses. Finally, if you had any stocks remaining, he wrote, “Here is advice you won’t hear from any financial planner: sell all stocks, mutual funds, and index funds you own. Sell any bond that isn’t a Treasury or triple-A muni. Sit on your cash for a while so that you can get some sleep and clear your head. Yes, you might be selling at the bottom, but what’s the worst that can happen? You miss a big run-up? Do you really expect that? More likely, you’ll miss further losses.” He ventured that you should stay out of the market for at least two years.

Bear in mind that this article appeared alongside that year’s list of the Best Financial Planners in Dallas. We heard from several members of the Financial Planning Association who thought the advice was not only bad but ill-timed. This year, they asked if they could have their turn. And so, with the benefit of hindsight, here’s an assessment of what we told you nearly two years ago:

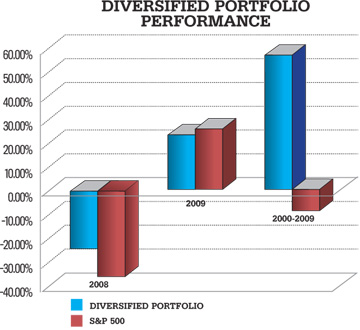

Marty Cortland’s recommendation to go to cash initially looked quite prophetic. The S&P 500 continued to fall another 12 percent, for an ultimate descent of 57 percent—one of the worst drops in U.S. history. But then the unthinkable happened on March 9, 2009, the day my rebuttal was published on D Magazine’s FrontBurner blog (yes, it is sometimes better to be lucky than good): the market bottomed. The Dow and the S&P 500 then embarked on one of the fastest upswings in history. From the low of March 9 to April 23, the S&P 500 increased 80 percent. Cortland’s advice proved to be very costly.

Some readers may point out that the two-year time period Cortland referred to is not over. In fact, he may ultimately be proven right. The market could crash again. But, no, that wouldn’t matter, because Cortland made a market timing call. The opposite trade was to stay in the market, and if you had kept your cool, you would now be taking your gains.

Market timing is very difficult and almost impossible for the average investor. You have to make a decision when to leave and then when to return to the markets. Then you multiply those decisions by the number of bear markets in your lifetime. The odds are against you.

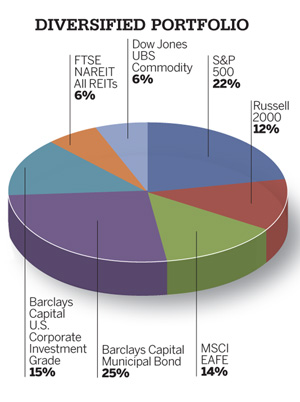

The true benefits of diversification are seen during longer periods. If we look at the performance of the above portfolio over the last 10 calendar years (January 1, 2000, to December 31, 2009), the performance of this portfolio is up 57 percent—a huge gain over the S&P 500, which lost 9 percent in the same time.

Warren Buffett may have put it best when he said, in an October 2008 New York Times editorial, “Let me be clear on one point: I can’t predict the short-term movements of the stock market. I haven’t the faintest idea as to whether stocks will be higher or lower a month—or a year—from now. What is likely, however, is that the market will move higher, perhaps substantially so, well before either sentiment or the economy turns up. So if you wait for the robins, spring will be over.”

Advisers around the country are now working with these battered investors to readjust their lifestyles in order to formulate a plan that will maintain an income for their lifetimes. Yes, we all have to be responsible for our own actions. But, in my opinion, the media can and did exacerbate the levels of panic.

Good habits are timeless: eschew consumer debt, hold adequate cash reserves so you do not have to sell assets when their values fall, maintain a diversified portfolio of investments, attempt to keep your emotions from driving your financial decisions, and, finally, be aware of the credentials and background of any author you read.

Remember: all bear markets eventually end, and this one will, too.

Mark McClanahan is the chairman of the board of the Dallas Fort Worth Financial Planning Association.