There sure was a lot of handwringing about the Federal Reserve Board’s decision last year to raise interest rates from near-zero levels. And I’m not referring to worries that higher rates might slow down growth or cause problems for post-recession borrowers still struggling with post-recession debts.

Rather, there remains a group of Fed watchers and political critics convinced that holding down interest rates for so long endangered a fragile economy. Some, including presidential hopeful Sen. Ted Cruz, have called to “audit the Fed” and increase congressional oversight, reflecting public distrust that mushroomed after the financial crisis. But given the economy’s steady recovery from the Great Recession, and the lack of any meaningful inflation, it’s hard not to conclude that the Fed’s policies have worked.

Look at almost any economic measure and you can see that things have improved markedly since the end of the financial crisis, even in the last three years as pressure mounted on the Fed to “normalize” rates. Unemployment in the U.S. peaked near 10 percent in the Great Recession and finished 2015 at 5 percent. Signs of progress are all around us in North Texas, from continued job growth to commercial projects like the new Toyota campus in Plano and the $200 million hotel and entertainment district unveiled in Arlington.

Low rates have sparked strength in two particularly critical industries: homebuilding and auto manufacturing. GM Financial, the Fort Worth-based finance arm of the Detroit automaker, has added hundreds of jobs at its south Arlington campus with GM expanding the lender’s role as car sales took off.

GM Financial President and CEO Daniel Berce says he believes Fed chiefs Ben Bernanke and Janet Yellen have done a good job. “I think they’ve been on a very prudent path,” he says. The recovery has been slower than desired, with wage growth stalled, and we’ve seen oil prices collapse and stock prices waver (perhaps a sign of overvaluation). But there are many other factors at play that are outside the Fed’s control.

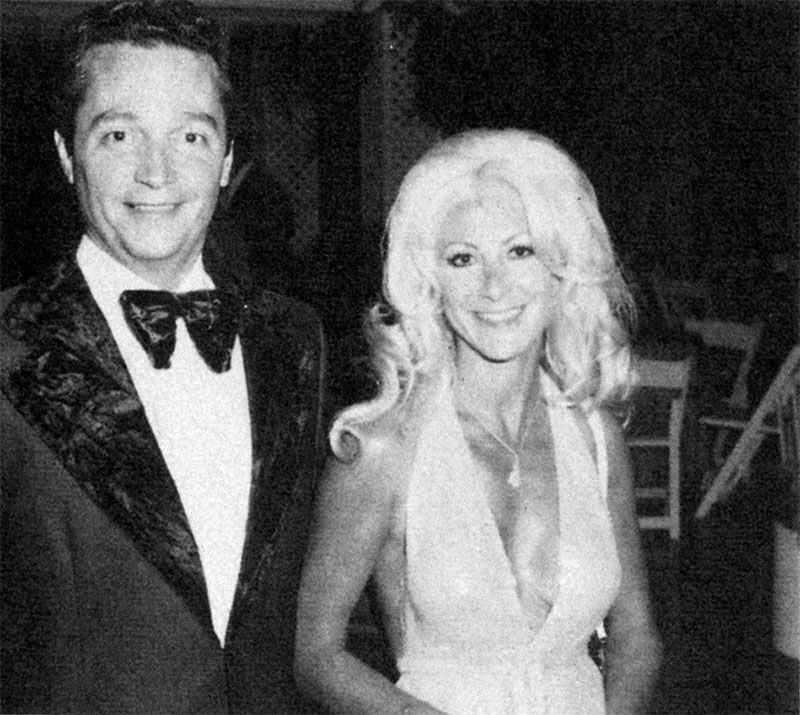

Speaking in Fort Worth in November while promoting his memoir, “The Courage to Act,” Bernanke defended his policy decisions, saying that the country’s economy is much safer than it was in 2007.

“The main thing low interest rates have done is support the economy and put millions of people back to work,” he said “That’s the best thing you can do for the broad public.”

And the normally Yoda-like figure turned testy responding to the notion that Fed policy has benefited the wealthy at the expense of the general population by driving up stock prices and broadening the nation’s income gap: “What was the Fed supposed to do, let the country stay in deep recession?”

Congress was little help, he said, thanks to political paralysis that led to sequestration, so it was left to the Fed to support the economy. Auditing the Fed now would only politicize the situation further. “I’d rather have [Yellen] in charge of monetary policy than your representative congressmen,” Bernanke said.

Even Richard Fisher, who became known for his dissents from the Fed’s easy money policies while president of the Federal Reserve Bank of Dallas, is keeping an open mind. In colorful speeches, Fisher, who retired last year, warned repeatedly that the Fed’s actions were creating long-term risks such as asset bubbles. Now he thinks the central bank is on a better path.

“They have been administering Ritalin to the markets for the longest period of time; that’s a dangerous thing to do,” Fisher said on CNBC after the December rate decision. “You will not know if this was long-term successful until we normalize, whatever that means, and we take some of this drug out of the marketplace and see how it settled down. So far, so good.”

Somehow it’s fitting that one of the hottest tickets on Broadway is “Hamilton,” a hip-hop musical that celebrates the founding father who created our national bank. A standing ovation would be too strong, but the Fed does deserve its due.