Thirty years ago, plunging oil prices sent the Texas economy into a nosedive. As oil money disappeared, real estate values plummeted, and many big Texas banks went belly up. Many of the state’s business elite probably have lingering nightmares about those dark days in the mid-1980s, when many a fortune was lost.

The bad dreams might have been more frequent in recent months. The price of oil fell from more than $105 a barrel last October to $50 a barrel in early February. So, can the Texas economy, which has led the nation in growth and job creation in recent years, keep rolling along without high oil prices?

An economy that had been devastated suddenly found it no longer needed high oil prices to prosper.

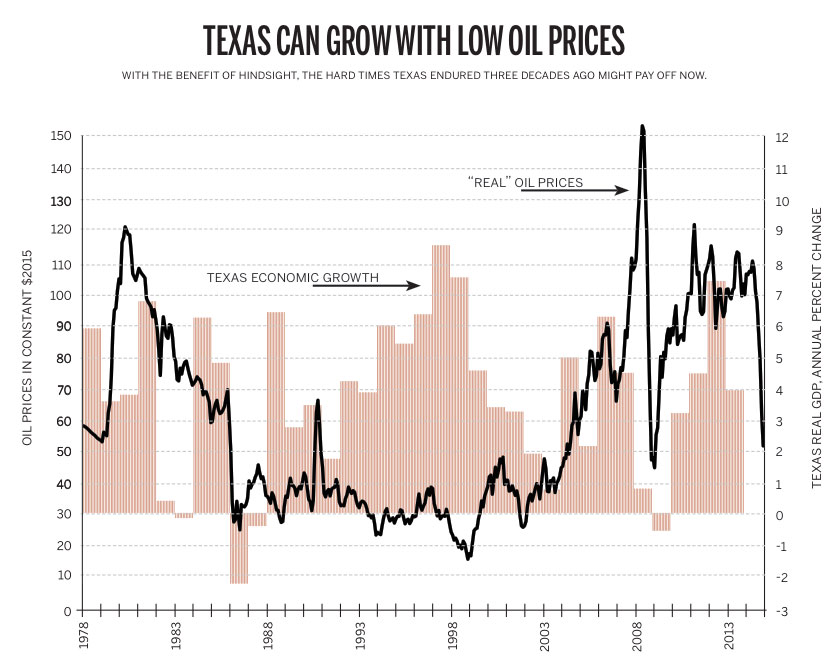

Inflation-adjusted GDP growth provides the broadest measure of the Texas economy’s strength (top chart, red bars, page 84). In the mid-1980s, the United States had shaken off recession and was growing again, but a 50 percent-plus drop in oil prices put Texas’ economy in a funk, with real GDP shrinking by almost 3 percent in two years. No doubt, oil was driving the state’s economy back then.

After that, oil prices remained relatively low for nearly two decades. But the Texas economy strongly bounced back, growing at an annual average rate of more than 4 percent from 1986 to 2005. Something extraordinary had happened: An economy that had been devastated by an oil-price collapse suddenly found it no longer needed high oil prices to prosper.

The 1990s brought strong growth for the nation as a whole. Texas took advantage of the good times to diversify its economy. Resources moved out of the energy sector because sustained low oil and gas prices suppressed opportunities for profit.

As a share of state personal income, oilfield revenues peaked at 26 percent in 1948, when prices were low, production was rising rapidly, and Texas’ non-energy sectors had yet to take off. In 1981, oil’s share of the economy spiked again to 25 percent. The low point came in 1998—1.4 percent. High oil prices and the recent production boom brought oil back to only 9 percent of a much larger economy.

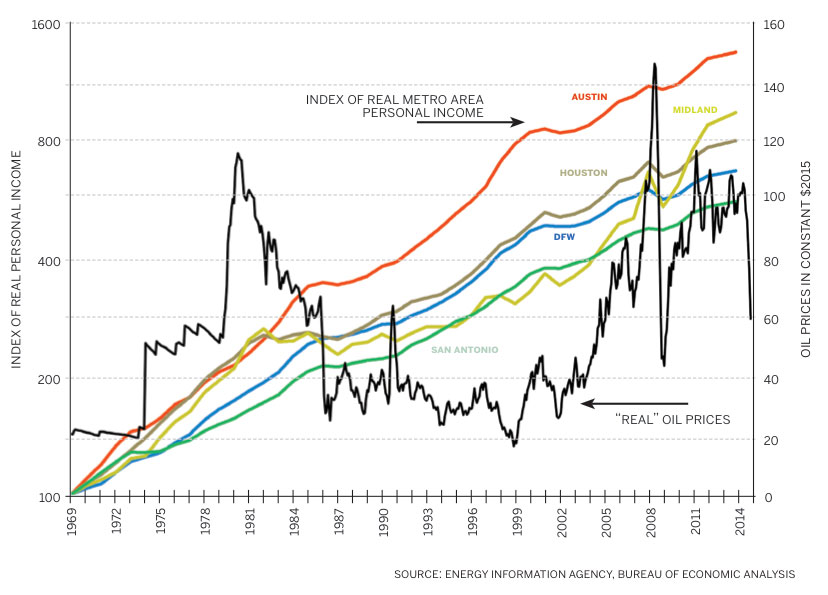

The state’s metropolitan areas provide another view of the oil bust of the mid-1980s (bottom chart, page 84). From 1985 to 1987, Midland suffered an outright decline in real personal income—it grew poorer. Houston saw a prolonged flattening of growth. The fallout was less severe in Austin, the Dallas-Fort Worth area, and San Antonio.

In the two decades of low oil prices that followed, personal income grew in all of the Texas metropolitan areas, with Austin leading the way. Facing low oil prices, the energy-focused city of Houston did slightly better than DFW from 1988 to 2005. Midland lagged for a while, but even its prospects were brightening by the mid-1990s.

When prices were high from 1981 to 1983, the oil sector’s share of annual tax revenues averaged 12 percent. In recent years, real oil prices have been as high as they were in the early 1980s, but the state budget’s reliance on oil averaged less than 5 percent from 2012 to 2014.

The Texas Advantage

Commentators outside the state portray Texas as being just plain lucky, living off the bounty of the Jurassic era seas that left behind organic matter that morphed into oil and gas deposits that have enriched Texas since the first Spindletop gusher in 1901.

That oil-soaked view may have been true in the past, but not today. Texas’ rapid diversification highlights the real reason for the state’s success: a high level of economic freedom. The latest Economic Freedom of North America index, published by the Fraser Institute, finds Texas tied with South Dakota as this country’s most economically free state.

TEXAS CAN GROW WITH LOW OIL PRICES

With the benefit of hindsight, the hard times Texas endured three decades ago might pay off now.

Keeping spending, regulation, and taxes low, while allowing labor markets to function with few restraints, has freed the Texas economy from the heavy hand of government, giving greater scope to markets to efficiently reallocate resources and drive growth and create jobs. In addition, economic freedom has attracted companies and migrants from other states and the rest of the world.

States that rank low in economic freedom, like New York and California, put burdens on their companies and workers, sapping incentives for expansion and job creation and slowing growth.

It’s easier for outsiders to attribute Texas’ boom to oil rather than acknowledge the superiority of the model of greater economic freedom. In Texas, for example, the government didn’t stand in the way as entrepreneurs like George Mitchell in North Texas’ Barnett Shale formation developed hydraulic fracturing (fracking) and horizontal drilling technologies.

Source: Energy Information Agency, Bureau of Economic Analysis

An arm of the Marcellus Shale formation extends beneath New York, but that state has passed laws that effectively prohibit fracking. California imposes strict rules that put much of its offshore oil deposits off limits to development. Greater economic freedom would have allowed either state to benefit from new jobs.

When looking at countries blessed by natural resources, economists often bring up what’s been nicknamed “the Dutch Disease” because of the repercussions of Holland’s discovery of oil in the North Sea. This terminology describes how outsized money inflows from oil, minerals, or commodities disadvantages the economy’s other sectors by distorting prices. These sectors struggle to compete and eventually shrivel, leaving the economy more dependent on its cash cow and vulnerable to wild swings in prices.

Texas might have been headed that way in the 1980s; continued high oil prices probably would have left it more skewed toward energy production. However, the oil bust shunted the state’s economy onto a different track. In an environment of economic freedom, two decades of low prices gave Texans and in-migrants incentives to develop the non-energy parts of the economy. With the benefit of hindsight, the hard times Texas endured three decades ago may be a blessing in disguise.

[aside id=”1″]Now, Texas’ economy stands out as one of the nation’s most diverse. At the end of the U.S. recession in 2009, oil prices were once again low, but Texas’ economy didn’t follow the nation in slogging through a halting recovery. In the past six years, as oil prices rose, Texas added a booming oil sector to a broadly diversified economic base. Texas grew faster than any other state, creating more than half the nation’s new jobs from 2000 through 2014.

If it lasts, the slump in oil prices will take some of the sizzle out of Texas’ economy. But in the past two decades, oil and gas have become far less important; non-energy businesses carry greater weight, and Texas’ economy doesn’t need high oil prices to thrive.