If they’re the smartest guys in the room, why are they paying 15 percent interest on almost $2 billion of debt? And 10.3 percent on another $15.5 billion?

Homebuyers today can get mortgages near 3 percent, and 10-year Treasury notes pay half that. But the private equity firms that bought the state’s largest power company in 2007 are practically financing it on a credit card. And when billion-dollar bills come due, they roll ’em over at double-digit interest rates.

They have little choice, because they’re not making enough money to cover the note.

The $45 billion leveraged buyout of Dallas-based TXU Corp. was the largest ever, so when it goes bust, as most expect to happen in the next year or two, the post-mortem will be summed up as a bad bet on natural gas prices.

True enough, but that doesn’t do justice to the hubris of the famous lead investors—KKR, TPG and Goldman Sachs. And it gives a pass to many state leaders, whose responsibility included protecting the public, not just getting out of the way of freewheeling enterprise.

In business, they call this risk-taking, and it was a go-for-broke gamble that broke—and never should have happened. Loading up debt on real estate, casinos and technology companies is fair game for private equity; it shouldn’t be for the largest utilities, even in a deregulated market like Texas.

That’s not just hindsight. In 2007, lawmakers, regulators, analysts, and consumer advocates were screaming about the giant debt load and potential effect on electric rates and power generation.

But a powerful lobby rolled over the opposition. Together, TXU and private equity hired 86 lobbyists and spent $17 million on the cause. When lawmakers proposed that the Public Utility Commission review the buyout, elder statesman James Baker (former secretary of state, U.S. Treasury secretary and White House chief of staff) threw down the hammer: Hired as chief adviser for they buyers, he said they’d walk away if they had to satisfy the PUC.

So the Legislature passed a bill requiring PUC oversight of future buyouts only, not TXU. Not to worry: After TXU, there may never be a utility LBO of this scale again.

When the buyout closed, the company was renamed Energy Future Holdings. It’s the umbrella over a power generator (Luminant), retail electric provider (TXU Energy), and regulated transmission business (Oncor).

The big debt hit is easy to illustrate today: EFH spent nearly $4.3 billion on interest last year. In 2006, before the buyout, TXU paid $830 million for the same expense.

Not coincidentally, EFH reported a net loss of $1.9 billion last year, following a $2.8 billion loss in 2010. In the two years pre-merger, TXU net profits totaled $4.3 billion.

This is more than a debt story. Private equity was banking on strong natural gas prices, which set electric rates in Texas. If prices stayed near $8 per thousand cubic feet and everything went as planned, all would be fine.

In mid-2008, natural gas prices topped $13, and the deal looked sweet. That turned out to be the high-water mark. Prices soon began a long, steady decline—first because of the recession, and then because of sharp growth in shale gas production.

By 2009, prices were down to about $3.50; this year, they’ve been lower than $2. Falling electric rates have been a windfall for customers and a blow to EFH. Last year, revenue was $4.4 billion lower than in 2008.

So EFH has the worst of all worlds: plunging revenue and soaring interest costs.

With almost $57 billion in future principal and interest payments, most believe a restructuring is inevitable, and probably a bankruptcy. KKR wrote off 90 percent of its investment. And Warren Buffett’s Berkshire Hathaway, which bought $2 billion of EFH bonds, slashed the value by almost $1.4 billion on the “big mistake.”

At the time of the deal, no one imagined natural gas prices falling so steeply. But there was reason to wonder about the rosy projections from the buyers. The TXU board urged shareholders to approve the offer for two major reasons: First, the bid was 25 percent higher than the company’s recent market cap; second, natural gas prices embedded in the implied value “were higher than the future TXU Corp. management thought were likely.”

TXU execs were right. So while investors lost billions, stockholders celebrated and TXU CEO John Wilder walked away with a $277 million payout. Well played!

Today, EFH officials point out that they completed three coal plants, added 1,900 jobs, improved customer service, and operated plants safely. They insist the balance sheet trouble hasn’t contaminated the utility, and the lights will stay on.

Others believe some effects are inevitable. It’s hard to imagine EFH investing in new generation for years, for instance. But we’ve seen major institutions survive terrible ownership. The Texas Rangers suffered a lost decade and went bankrupt, yet the team is stronger than ever under new leaders.

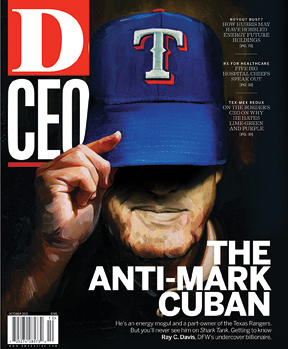

Another sports owner, Mark Cuban, could explain what happened with TXU. He’s had many failures—starting a bar, selling powdered milk, getting fired—and they shaped his philosophy.

“It doesn’t matter how many times you strike out,” Cuban once wrote on his blog. “In business, to be a success, you only have to be right once. One single solitary time and you are set for life.”

That’s the way to make, and sometimes lose, a fortune. But is it any way to run a utility?