“When they go through the same hardships, they experience the pride that comes from building something out of nothing,” McVean says. “The end result of that entrepreneurial experience is that you sleep with the comfort of knowing, ‘I can do this. I’m never going to have to doubt myself again. I’m never going to have to work for anyone else again, unless I want to. I’m going to be fine.’”

Early hires have since become “second-generation” leaders within the organization. Those individuals, in turn, are training and nurturing the third generation. “We’re taking all of this from Trammell Crow; this is what he did,” McVean says. “We’re copying it—with his blessing.”

One area that has worked out particularly well for Stream is data centers. The company got into the field relatively early—in 1999. As he was going about leasing office space, Belland says tenant brokers kept asking about data-center availability. He had no clue what they meant.

Then one day, McVean was out driving the market, and noticed a big sign off Stemmons that said, “Data Center for Sale.” It was a 1960s building that EDS had converted into a data center.

The partners put it under contract, and inked a 15-year lease to AT&T before the acquisition closed. Rob Kennedy, one of Stream’s “talent hires,” decided there was an opportunity there, and found another data center nearby. Stream bought it and, again, leased it while it was

still under contract, this time to Nokia.

Since then, the company has become an active national player in the data-center space, as both an investor and a developer.

“In addition to us being tuned into supply and demand, we might credit [CB Richard Ellis vice chairman] Jeff Ellerman for his choice of words on that sign: ‘Data Center for Sale,’” McVean jokes. “That really started it all.”

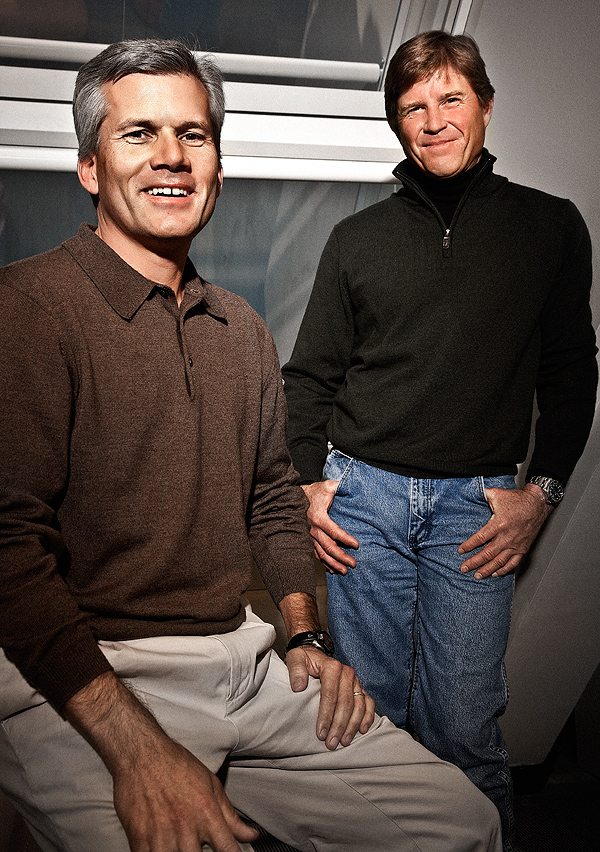

Today, Stream has more than 370 employees in six markets: Dallas, Houston, San Antonio, Austin, Atlanta, and Orange County, Calif.

The Stream co-founders say they’re a bit surprised at how well they’ve done and how big the company has become. They’re most proud, they say, of the wealth they’ve helped create for those who aided them in building the business.

“There are a whole lot of millionaires who work here with us—a lot; [some are] multimillionaires,” McVean says. “We’re proud of the fact that we’ve given people an opportunity and shown them how to get real rich. When you see that happen to people and see them get that sense of comfort and peace, that’s pretty gratifying.

“Lee and I started Stream, but we’re all a part of it now. It’s not just us doing for them; it’s them doing for us, too.”

CASE Commercial Real Estate Partners

When John Conger graduated from Southern Methodist University in 1979, few careers held more allure than commercial real estate. “Coming from a smaller town, seeing all of the highrise buildings under development downtown was quite a sight,” he says. “Half of Dallas was built at the time. Cranes were everywhere. Leasing highrise office space was a glamorous job for a young kid; I had to be a part of it.”

Conger has focused on project leasing ever since, joining Dallas real estate developer and investor Bill Cawley about 15 years ago to run Wilcox Realty Group, a services firm Cawley had acquired from Ray Hunt.

Tom Sutherland, meanwhile, got his start in 1984. He had always been intrigued by the industry, studying architecture and construction, along with marketing, at Texas A&M. He went to work for a retail developer out of school, but within a couple of years, the Dallas real estate market began to crumble. Sutherland decided to get out.

In an interview with Pitney Bowes-Dictaphone, the manager eyed Sutherland with suspicion. “He told me, ‘All signs are pointing to the decision to hire you. My only reluctance is, it has been my experience that a guy who has been in real estate won’t ever get that out of his blood,’” Sutherland says. “I told him, ‘Hell, no! That business is crazy!’ I got the job. But seven years later, I walked into that manager’s office and told him he was right: I had to get back into real estate.”

This time around, Sutherland focused on office tenant representation. “At Pitney Bowes, I had been calling on downtown law firms, selling them little $500 dictaphone systems,” he says. “I figured, why not sell them real estate services and make much bigger fees?” He joined Fults Cos., then shifted to CB Richard Ellis in 1997. At the time, CBRE “was a sleeping giant,” Sutherland says. “It was a large national firm, but its Dallas office was relatively small. I thought I was catching the wave at the right time; they were putting a lot of money into growing their local operations.”

He worked under manager Ran Holman, doing tenant rep and forming the company’s high-tech practice group. CBRE made good on its promise to grow. When rumors began flying about a merger with Trammell Crow, Sutherland decided to look around at other options.

“I thought, ‘This is great for CB and great for shareholders, creating this global brand, but the reason I got into real estate was because I liked the local flavor and the entrepreneurial side of it,” he says. “CB was getting so corporate, I was beginning to feel like a number. By this time, Ran had moved over to Cawley; I talked with him and with Bill, and decided to join, too.”

Conger was running the management and leasing side; Sutherland stepped in to run the tenant rep and brokerage group. As Cawley began to focus more on his investments and development arm, Cawley Partners, the two division heads made a pitch to buy out the services group, which was then called GVA Cawley and affiliated with the GVA Worldwide network.

“We had a willing seller and willing buyers,” Conger says. “Bill understood that for Tom and me to run it best, having ownership was the way to go, and he agreed to sell it outright.”

The ownership change happened in April of 2008. The first year wasn’t easy. Not only did the duo have to deal with the ensuing economic depression, they had personal trials as well. After a dinner with Conger to celebrate the new venture, Sutherland came home to find his wife collapsed on the bathroom floor. They later learned she had a brain aneurysm and needed emergency surgery. Shortly thereafter, Conger’s brother’s battle with cancer took a turn for the worse. He died in early 2009; Sutherland’s wife passed away in January 2010.

“It was a tough time, but from a financial standpoint, we had a good 2008,” Sutherland says. “In 2009, we started talking about what we wanted to be. Initially we had kept everything as is, for stability’s sake. But in 2009, we knew the GVA affiliation was going away, and that it would be a good time to change the name of the firm.

“We also were talking to Cassidy Turley and going back and forth,” he says. “When the calendar turned to 2010, we were still thinking about that. But John and I decided that we were just too new into this to make such a big change. And neither of us wanted to be part of anything too global. The whole situation caused us to sit down and figure out: ‘What do we want to be?’”

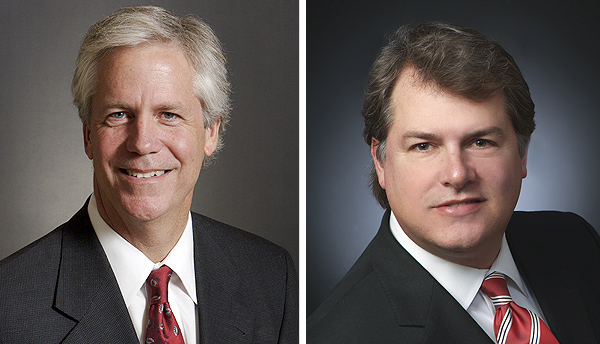

In the end, the duo decided to focus exclusively on Texas. Not only did it fall in line with their goals and interests, but all trends are pointing toward continuing growth and prosperity in the state. In August of 2010, they renamed the firm CASE Commercial Real Estate Partners, with CASE being an acronym for Conger and Sutherland Enterprises.

Since then, they’ve been on a hiring spree, making five new hires in December alone, bringing the total to about 75 people. The firm also has expanded geographically—CASE now has offices in Fort Worth, Austin, and San Antonio, with Houston the target for 2012—and diversified.

“Our health care, data center, and land services groups have helped get us through the tough times,” Conger says. “If you diversify, at least three of the eight specialties in different years are going to be flourishing—hopefully eight of the eight.”

One thing that hasn’t changed, he says, is the culture. “I give Bill Cawley credit for creating a culture that promoted the entrepreneurial spirit, and we’ve carried that forward,” Conger says. “We have an atmosphere where anyone can talk about ideas, and if they’re good, we’ll pursue them.”