It may be, but the media storm leading up to AT&T’s letter began because a video posted to YouTube by a systems administrator showed the Carrier IQ software recording all kinds of consumer data on the sly while phones were in use. Rather than explain its technology and empathize with consumers, Carrier IQ’s first reaction was to send the systems administrator a cease-and-desist letter.

Later, Carrier IQ made it clear that its service-provider clients were not surreptitiously snooping on consumers and that the YouTube post showed results that weren’t at all typical of how its technology was normally used. Still, consumers felt wronged. The very idea that consumer movements and activities were being “watched” by carriers caused uproar and, in response, Sprint, one of Carrier IQ’s clients, announced in December that it would disable the software on all of its phones.

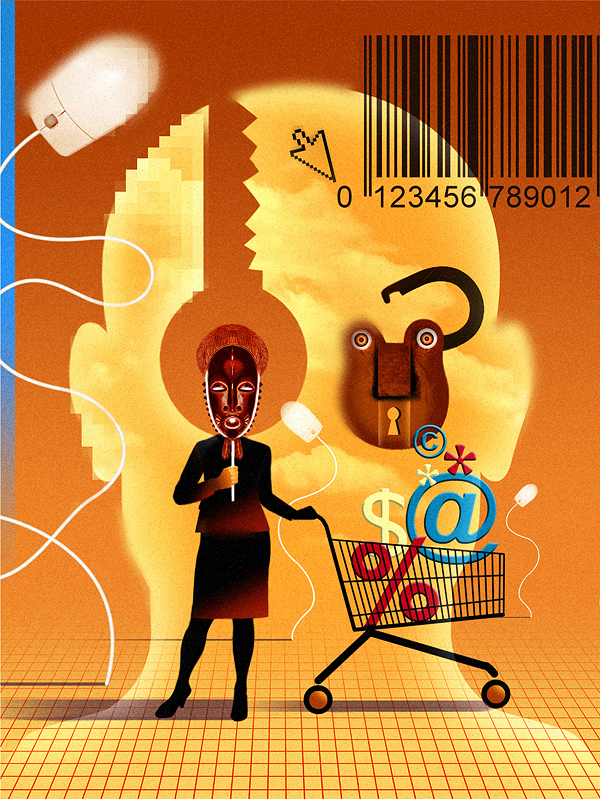

The New Currency: Trust

It is easier than ever for a business to get information about its customers, but it is difficult to know what you can do with what you learn.

In Identity Shift, Cerra, along with co-author and fellow SMU grad Christina James, surveyed 5,000 American consumers and closely observed, interviewed, and recorded 30 families, including five from Dallas. In an attempt to learn more about “the human spirit behind our interconnected networks,” Cerra hit a central theme that crushed Carrier IQ.

“Trust is the currency of our lives now,” Cerra says. “It’s earned over time and it is lost in a moment.”

Through her work, the author discovered many inconsistencies. Researchers hear folks saying one thing and observe them doing another. In one of the book’s anecdotes, a protective mother keeps the family computer in a shared room and closely watches what her kids do online. But while researchers are present, she casually tells her daughter to click through and ignore a PC security warning that popped up while browsing the Internet.

Cerra says the mother’s “learned helplessness” probably comes from seeing too many false alarms from the very same software programs and safeguards that are supposed to be protecting her.

She writes that consumers are well aware of the dangers of sharing too much data with sketchy sources. But dangle a coupon and all bets are off: “Despite this knowledge [of online threats], more than half in our study often share information about themselves in exchange for coupons, discounts, and updates. More than 20 percent admit to sharing as much as they can in order to get better, customized online deals. The knowledge of a threat is real, but it does little to deter the behavior of the U.S. consumer.

“We are not always rational, as much as we rationalize,” Cerra says.

And who we are online doesn’t always square with who we really are. That fact puts pressure on companies that want to use social media,

get closer to their consumers, and mine all the data that our digital lives make available to provide better products and services.

This all comes back to the iPhone, probably the most powerful catalyst shaping today’s digital consumer.

We’re entering a golden age of customized services, tailored advertisements, and made-to-order entertainment. But companies must be

careful to empower consumers without exploiting them. Consumers want services catered to them, but they also want privacy. Even if they treat their own personal details with indifference on Facebook, businesses can’t.

“It’s not exactly a clean debate,” Cerra says. “You want to have diagnostics, but at the other end, you have to be transparent so that you’re not perceived as doing something that’s not trustworthy.”

She adds: “The good news for service providers and companies in this debate is that … there is a trend where consumers are starting to understand when they use online services that if you’re not paying, you are the product.”

Still, she says transparency is the best policy for any facet of business touching the digital consumer. That brings up the “shift” in our thinking, a central premise of Cerra’s book. It’s time to move the debate away from how to build just the right service, offer, or incentive for consumers. Instead, Cerra says, companies should give consumers the power to monitor, measure, and really understand what they’re opting into. Let them build it themselves and keep their offers, policies, and rewards transparent and simple.

“With consumers, if you try to get it all right, you’re going to get it wrong,” she says.

Phil Harvey is editor-in-chief of Light Reading, a UBM TechWeb publication covering the global communications industry.