All comebacks are not created equal.

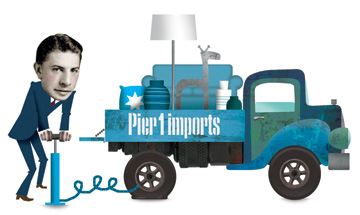

Pier 1 Imports fought back from the brink the old-school way—on its own, with no help from a bankruptcy judge or white knight or Uncle Sam.

The turnaround plan was deceptively simple: get back to Pier 1’s roots as a great merchant, size the business right, and be relentless about execution. And, if opportunity arises, pounce.

“We determined the strategy early on and never changed it,” says president and CEO Alex Smith, a 30-year retail veteran recruited in February 2007. “We used the recession to get better and better at what we were doing.”

Simply surviving the Great Recession is an achievement. Remember The Sharper Image, Linens ’n Things, Bombay & Co., KB Toys, Wickes Furniture, Mervyns? They all went bankrupt around the time Pier 1 was a penny stock (eventually trading as low as a dime), and Morningstar called a Pier 1 bankruptcy “a distinct possibility.”

At one point, Pier 1 posted 17 consecutive quarters of declining same-store sales. After a small rise early in 2008, sales fell for the next year and a half. To appreciate how bad things were, consider that Pier 1 recently reported an operating profit for the May quarter—for the first time in six years.

Most specialty retailers don’t rebound from such a drought. With the housing bust and big-box stores poaching every category, did the country need another national chain for candles, wicker furniture, and knickknacks?

“There were never any questions internally,” Smith insists, adding that it wasn’t difficult to recruit talent even in the darkest days. “People on the outside don’t understand that everybody loves Pier 1.”

Pier 1 started almost 50 years ago, south of San Francisco. With love beads, incense, and beanbag chairs, it became a baby-boomer icon and grew up with its customers. By 2000, sales topped $1 billion, and Pier 1 soon had more than 1,000 stores and a landmark tower in downtown Fort Worth.

By early 2007, the housing slump began and things fell apart. Pier 1 lost $228 million, a devastating amount for a company that almost always operated in the black. In came Smith, a native Brit, and he closed stores, dropped the kids line, laid off employees, killed catalogs, cut marketing by half, even abandoned the online sales operation.

But it wasn’t all slash and burn. Perhaps Smith’s most important decision was to hire people. He tripled the number of buyers, planners, and “allocators”—the specialists responsible for stocking Pier 1 with one-of-a-kind merchandise and keeping the assortment just right.

He also shifted many employees and brought in outsiders. The executive team has four holdovers, including longtime chief financial officer Cary Turner. But Smith assembled a new group to handle key areas, drawing from Pier 1’s competition.

In his first year, he expanded Halloween sales. Outdoor furniture was a hit, and women’s jewelry was gaining traction. Imported foods didn’t fly, but the mix kept getting better, and Smith saw customers responding. Then the recession deepened, and sales went south again.

All the while, the company was attacking costs and working the supply chain. Before Smith arrived, Pier 1 had begun simplifying the business, selling off its United Kingdom stores and credit card unit. Then Smith hit the accelerator hard and, within three years, Pier 1 was cash-rich, nearly debt-free, and earning record margins on its merchandise.

Pier 1 has 1,050 stores today, 267 fewer than its peak, and it leveraged the recession to rework more than 300 store leases. Occupancy costs fell $26 million in two years, and operating leases, a long-term measure of that expense, are $750 million lower than five years ago.

Pier 1 cut overhead by $228 million, or 35 percent. Store payroll alone is down $50 million. Pier 1 has 2,000 fewer employees, but the mix has changed, too. In 2006, Pier 1 had one full-time worker for nearly two part-timers; in 2010, part-timers had a 4-to-1 edge.

“Everybody in retailing is doing that,” Smith says.

But who’s managing debt like Pier 1? In early 2009, when investors were trembling and cash was king, the company went bargain hunting. It bought $79 million of its own debt for 34 cents on the dollar. Later it pulled off a convertible stock offering that eventually swapped equity for more debt. Seizing the moment, Pier 1 cut long-term debt from $184 million to $9.5 million.

“We hit it perfect,” Smith says.

The same holds for its headquarters sale, which provided cash for the debt deal and let Pier 1 lease about half the space. In June 2008, natural gas producer Chesapeake Energy paid top dollar for the headquarters, $104 million. That was a month before natural gas prices peaked and commercial real estate started to fall.

Pier 1 has $205 million in cash today. But sales will always be the crucial number at Pier 1 and, for the past three quarters, same-store sales have grown. In the May quarter, they rose 14.3 percent.

When Smith arrived three years ago, he said Pier 1 had to get to profitability and beyond. For CFO Turner, a Pier 1 executive for 18 years, it’s time for the next step.

“I’ve seen the good, the bad, and the ugly,” Turner says, “and now I’m ready for the great.”

Mitchell Schnurman is the business columnist for the Star-Telegram. For the past five years, his column has been named the “Best in Business” by the Society of American Business Editors and Writers.