As degreed engineers, Jack Lafield and his two partners at Dallas pipeline company Caiman Energy LLC know how to spot, design, and build new opportunities in the natural-gas business. In fact, they have a history doing it.

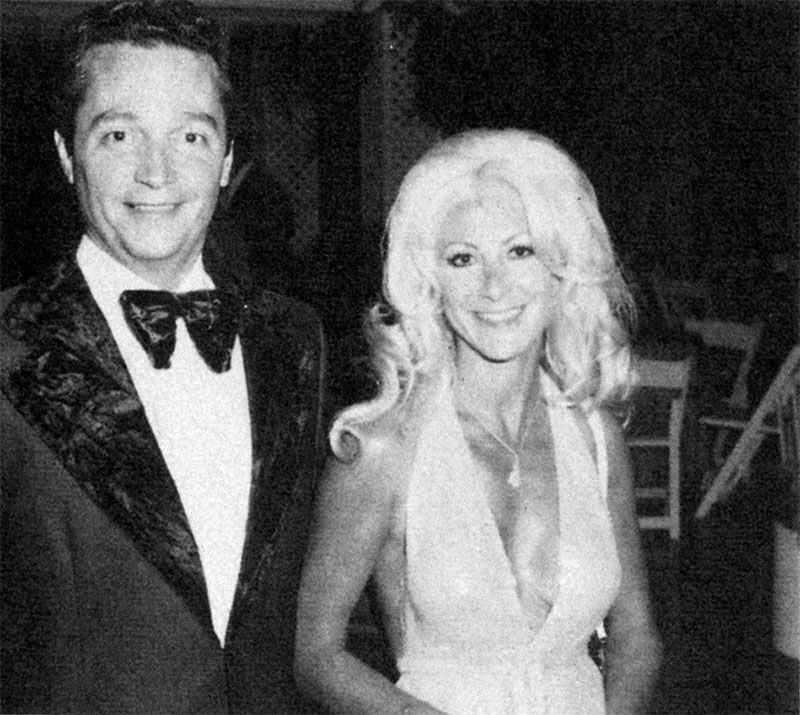

Lafield, who’s Caiman’s president and CEO; Danny Thompson, executive vice president-engineering and operations; and Rick Moncrief, EVP-chief commercial officer, have been acquainted with each for years. Most recently they helped develop North Texas’ Barnett Shale gas field and the Haynesville Shale in northwestern Louisiana, southwestern Arkansas, and eastern Texas. Thompson, 60, and Lafield, 59, were key executives in the Barnett for Crosstex Energy LP; Moncrief, 50, worked the Haynesville for Regency Energy Partners.

After leaving those companies for various reasons and founding Caiman last year, the trio quickly realized that the natural-gas play with the most promising future was the Marcellus Shale, in the Appalachian Basin. So that’s where Caiman has been concentrating its efforts, developing “high-capacity” pipeline and processing facilities mainly in southwestern Pennsylvania and northern West Virginia. Other Barnett Shale companies have also rushed to the Marcellus natural-gas field, the country’s largest.

“I’d estimate that more than $5 billion has been spent on new midstream infrastructure in the Barnett Shale,” Lafield said the other day, chatting in Caiman’s new 9,000-square-foot office in the Sterling Plaza building on Sherry Lane. “The Haynesville Shale is going to see $10 billion spent. So will the Eagle Ford [Shale in South Texas]. But, we’re probably going to see 10 times that spent in the Marcellus over the next 20 or 25 years.”

Caiman is well-positioned to profit from those outlays after securing $400 million in private-equity commitments in July from EnCap Flatrock Midstream, which includes nearly 20 institutional investors.

Private equity is better suited to companies like Caiman than master limited partnerships, the ownership structure that’s bankrolled a number of shale companies to date, Lafield believes. The main reasons: private-equity investors have more tolerance for risk and don’t demand immediate returns while infrastructure’s being built out. At the same time, Lafield adds, Marcellus gas costs less to extract and offers companies a higher rate of return, because it’s closer to the big East Coast population centers and is a “higher quality” shale play.

That combination—the Marcellus’ outstanding potential and a pot full of patient money—seems to have Caiman sitting in the catbird seat. The company has grown rapidly from five employees to 23, including three at a new business-development office in Pennsylvania, and it’s looking now to hire at least two more engineers.