Seated in a place of honor next to Wintour during the Vogue magazine-sponsored confab, The Neiman Marcus Group president and CEO proceeds to ask for Wintour’s help: Since demand for luxury clothing is so great that shipments aren’t keeping up, could the famous editor of the women’s fashion bible nudge designers to ship product a little faster?

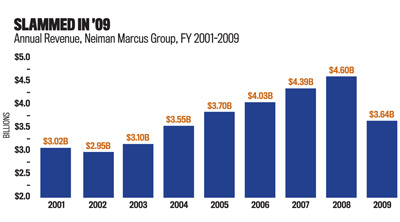

The September 2007 issue of Vogue featured in the film brought in so much advertising that it weighed just over four pounds. Neiman Marcus, too, had a heady autumn in ’07, with its 100th anniversary gala and comparable sales zipping along at 6.5 percent over the prior year’s strong quarter. Before the year was out, Tansky would sign a new contract extending his tenure through October 2010.

Then the Great Recession hit, and the world turned upside down.

By the end of September 2009, Tansky’s legendary luxury specialty retail department-store company had posted sales declines for 14 consecutive months. Groaning under about $2.95 billion in debt, the company’s credit ratings had been sharply downgraded. Adding insult to injury, Tansky was one of several executives named in a January 2009 BusinessWeek article who was said to be “walking a tightrope” in this shaky economy. The New York Post reported rumors of the CEO’s early retirement.

Tansky “has a performance record over a long period of time that’s no less than superb, but he’s in a perilous situation,” says Howard Davidowitz, a retail consultant and investment banker. “The question is: Is he the one to be the change agent, to lead the changes that have to happen?”

That, indeed, is the $64,000 question. The economy seems to have ended its slide as of this writing, though the Federal Reserve has warned that recovery will be slow. But predictions are that a full comeback that would see affluent folk cheerfully plunking down $3,550 for a Gucci handbag won’t come for at least another year—if in the foreseeable future at all.

Preliminary sales forecasts for the 2009 holiday season indicated more positive, but still modest, increases over 2008, itself a down market. And analysts say luxury retail will continue to do worse than more affordable retail categories. “There are some segments that will continue to struggle, and luxury is one of them,” says Ted Vaughan, a partner in retail and consumer products for BDO Seidman in Dallas.

As a result, the iconic store that Herbert Marcus Sr., his sister Carrie Marcus Neiman, and her husband A.L. Neiman founded in Dallas 102 years ago finds itself playing a waiting game under Tansky—preserving liquidity while finding a way to break what appears to be a psychological logjam in consumer confidence, as well as real losses in disposable income.

The Neiman Marcus Group—which also operates the upscale Bergdorf Goodman specialty retail department stores and Neiman Marcus Direct, a direct-marketing division—is far from the only luxury retailer to suffer in a recession that clobbered the top of the market especially hard. Its rival Saks Fifth Avenue also experienced steep sales declines, for example. Designer Prada renegotiated its debt. And Coach, the handbag maker, brought out lower-priced designs.

“It’s probably been the hardest period for high-end stores that I’ve ever witnessed,” says Richard Marcus, the grandson of Herbert Marcus, a former Neiman Marcus CEO, and an adviser to retailers.

Many of the customers who snapped up Manolo Blahnik shoes and David Yurman baubles were spending their perceived wealth—the soaring value of their homes or stocks—and have back come down to earth with a thud, says retail analyst Pam Danziger, president of Unity Marketing.

Consulting firm Bain & Co. doesn’t expect full recovery for high-end shopping until well into 2011, with lingering trends that include a strong focus on getting real value for the dollar.

Danziger’s firm surveyed affluent customers in Beverly Hills, Calif., “ground zero for the conspicuous consumption lifestyle,” and found evidence of the new value trend. “The power in the new luxury market is going to be in how smart the consumer is,” Danziger says. “These people can afford to spend, but charging 10 times as much for a product that’s three times better isn’t going to work.”

Other retailers and analysts are equally gloomy. Davidowitz, for instance, sees a full decade of slow growth—and accompanying slowed consumer spending, as the economy labors under federal deficits. Allen Questrom, a former Neiman’s CEO, says higher taxes will soon put more pressure on upscale consumers. And a retailer who asked not to be named adds: “People just don’t feel good. Nobody’s being real positive now. I don’t know where all this is going.”

Cutting Jobs and Expenses

Whether or not it was late to respond, the chain has moved to preserve liquidity while it waits for an uptick. Neiman Marcus, whose representatives declined to be interviewed for this story, has slashed 950 jobs, delayed store openings, cut store hours, renegotiated its revolving credit facility, and pared expenses by about $100 million in the fiscal year that ended Aug. 1.

In addition, Tansky announced early last year that Neiman’s was working with vendors to lower prices while maintaining its trademark quality and style. It’s a somewhat risky move, analysts say, but a necessary one.

“They’re making the changes they need to make,” Danziger says. “The fact is that they realize the luxury boom is over. They’re adjusting their merchandise for the new reality.”

The store did this during the Great Depression as well. But as severe as that downturn was, the Neiman Marcus of the 1930s had two advantages over today’s much larger corporate chain: family-owned, it could, and did, turn on a dime. The store was also aided by a Texas oil boom that had wildcatters coming to Dallas to spend their new wealth in style, just as Wall Street was sinking.

In contrast, today’s Neiman Marcus Group is privately held by investors Warburg Pincus and Fort Worth-based Texas Pacific Group, its debt largely the result of a 2005 leveraged buyout. It now owns 42 Neiman Marcus stores in addition to Bergdorf Goodman, Cusp, Horchow, clearance centers and its online and catalog business.

Comparable revenues, meantime, were down 21.4 percent for the year, to $3.64 billion. The company posted a net loss of $668 million, compared with net earnings of $142.8 million in the previous year. Inventories were down 23 percent, in line with the decreased sales.

“We believe Neiman Marcus can weather a protracted downturn in the luxury market, but expect results to remain weak near-term,” J.P. Morgan said in its analysis. Leverage should peak in the spring of 2010 before an expected rebound in earnings, it added.

In a conference call with institutional investors, Tansky—whose personal compensation reportedly rose by more than $500,000 in fiscal 2009, to a total of $3.9 million—declined to estimate when a rebound would occur. “We’re not in an environment that’s normal,” he said. “That’s why we’re planning conservatively.”

Last October the retailer once again made news with its storied Christmas Book catalog, featuring a $250,000 amphibious plane as the His-and-Hers gift, though nearly half the items featured in the catalog were priced at less than $250.

Targeted marketing through newer channels is the name of the game right now, says Furman of the Luxury Marketing Council. Neiman Marcus management is aware of the trend and is following suit, though it’s kept mum about details of “special events” it’s holding for its best customers. More obvious are free shipping offers on its Neiman Marcus Direct and Horchow online sites, as well as three-hour “flash” sales on women’s apparel.

“I have no inside knowledge, but my sense is that Neiman Marcus has been very astute at maintaining its relationship with their very best customers—the level of service and personalization for these people,” says Richard Baker, founder of the Luxury Marketing Council in Dallas-Fort Worth. “While I know they had to reduce costs, they’re doing their best to keep their brand intact. I think they’ll be among the first to recover. I think their customers are the ones who will come back to spending first.”

One of those customers is Erin Mathews, a highly successful Realtor specializing in high-end housing at Mathews Nichols Real Estate Group, which works with Allie Beth Allman & Associates. Yes, she’s cut back some, Mathews says, “but I’m still a very loyal customer.”

She buys her clothes and has them altered at the downtown store. “I can call my salesperson, tell him I’m at the Fairmont, and he’ll be at the curb [with the order] when I come around,” she says.

‘A Selling Organization’

A word that comes up frequently among observers of the Neiman’s culture is “editing.” Herbert Marcus’s son, the late Stanley Marcus—the Neiman’s president from 1950 to 1972, often referred to as the “merchant prince” and “Mr. Stanley”—is most famous for this sort of taste-making and customer knowledge.

But Mathews and others refer to it today as well. “You are still seeing the best of what each of the designers has to offer,” the Realtor says.

Another ingredient that observers believe remains in the company’s DNA—even though it may have gone a bit dormant during the boom—is the knack for selling.

“You go back to the family and the roots of the organization. It’s a selling organization,” says Frank Ball, a former Neiman Marcus executive who now owns Ball Group, a Manhattan consulting and talent-acquisition firm. “It’s sold camels and mummies. It’s sold one of the most expensive pieces of jewelry to one of the richest and most conservative men—Ross Perot.”

While he’s no longer close to the company, Ball says, the new Neiman’s executives he’s met “understand who they are and what their customers expect.”

Less pessimistic than some, Ball talks about the affluent customers who are sitting on the sidelines, just waiting to jump back into the market for high-end goods. As a result, he says, “the real challenge for the retailer, in my judgment, is to create a reason to buy.”

In charge of the downtown Neiman’s during the 1980s, when downtown Dallas was in decline, Ball’s charge was to bring shoppers back to the city center. There was, for example, a special program he created for Ford Motor Co., which had a tradition of honoring its top dealers each year with prizes selected from a catalog. Why not fly your dealers and spouses to Dallas, put them up at the Adolphus hotel, and give them a $5,000 gift card to shop at Neiman Marcus? Ball asked the automaker.

Ford, and later General Motors, bit. “We set up a cocktail party. Our execs would be there. We’d not only give them the gift card, but an additional discount,” Ball recalls. “We’d do $1 million in four hours in sales.”

Will that kind of spending come back—and soon enough—for Neiman Marcus? Or has there been a seismic shift toward frugality and environmental consciousness? Will the legendary store be able to gear its merchandise in those directions without losing the allure of its iconic brand?

“There is some relationship between luxury and the performance of capital markets,” Davidowitz says. “My own forecast is that luxury will be half of what it was. We’re simply not a country generating the kind of wealth that we used to.”

Vaughan of BDO Seidman notes that “things look bleak, but they move in cycles.” The luxury customer will be back, he says, “but what will that customer look like? It’s a question luxury retailers are trying to answer themselves.”

Neiman’s same-store numbers should start to look better, if only because the comparisons will be to anemic year-ago numbers, experts say. The company has taken “a lot of inventory out of the system,” says Standard & Poor’s analyst Diane Shand, “so there shouldn’t be as much gross-margin impact.”

However, she adds, “I don’t think the ‘aspirational’ customer will ever come back to the degree of 2007. They call it the ‘new normal.’ People aren’t going to spend as much.”

Questrom, the former Neiman’s CEO, agrees with Shand, adding that because Neiman’s has lost the aspirational segment, its stores may need less space going forward. In addition, he says, “hopefully this year they will cut back on the amount of promotions, because you can lose what you really stand for. They’ve also got to come to grips by cutting expenses—but you have to be careful. You have to make those changes transparent to your customers.”

Given all these pressures, will Burt Tansky, and Neiman Marcus, succeed over time? Richard Marcus believes so, with one big caveat. “This is a real test of leadership, and I think they will survive it,” Marcus says. “But it ain’t gonna be pretty.”

What Would Mr. Stanley Do?

Former Neiman’s Execs Say The Great Recession Wouldn’t Have Deterred Stanley Marcus.

Frank Ball [former senior vice president]: “When things were difficult, [Mr. Stanley] would come up with great selling ideas, and sell his way out of it. He created Fortnight, for example, because October was traditionally a dead retailing month. As a result of Fortnight, October became very prosperous for Neiman Marcus.

“A lot of retailers today are very conscious of the expense structure, but they need to spend more time figuring out ways to sell their way out of the problem. [While the luxury segment may be hurting now, Mr. Stanley] understood that people are willing to spend at different price points.

“Today’s environment would not deter him a bit. He would encourage people to come up with creative ideas that would work whether the economy was up or down or sideways.”

Tony Briggle [former vice president of public relations]: “Mr. Stanley was a very pragmatic man with high expectations, but—like his father and Stanley’s son, Richard—he was very flexible about dealing with the times. That’s why they stayed on top for so long. Rather than fight the times—and each decade had its own economic crises—Mr. Stanley always went with them. His philosophy was, you always give people the best—even if it’s an ice cream cone for $1.75, as long as it’s the best, people will pay for it. But if you try to scale down or scale back from quality, you’re putting yourself in a compromising position, and [customers] will balk.

“Today’s world is more difficult because we’re all more compromising and more willing to accept less that we used to. That’s where the high-end retailers are experiencing problems, because they’re all beginning to look alike. You walk into the second floor of Neiman’s and see racks and racks of $10,000 dresses marked down to $5,000—and pretty soon they begin to look like the $500 dresses you’d find at Dillard’s. By compromising the way they display to customers, they’re turning the customers off. Somehow, the big luxury retailers have lost their focus.”

Roger Horchow [former vice president of mail order]: “When the Neiman Marcus store burned down in the 1960s, [Mr. Stanley] took charge and solicited the sympathy of his customers and made it into an ‘event,’ saying something like ‘the phoenix was going to rise from the ashes.’

“In the current environment, I believe he would make it sort of personal by, say, running advertisements where he’d pick out something from the store stock and point out that it was not only unique, but a terrific value. Items priced at less than $50 or $100, say. That would be his way of telling people that—while they may not have the money these days to afford expensive items—Neiman Marcus offers much that has good value.” —Glenn Hunter

No Comment

Neiman’s CEO Adopts a Low Profile—Sometimes

For a company that’s long been known for its service, and for its outspoken leaders like Stanley Marcus, today’s Neiman Marcus seems less forthcoming—and not so big on service to journalists.

We first requested an interview with company boss Burt Tansky (pictured)early last year. Neiman Marcus replied that the timing was bad, given the economic recession. But it added that Tansky—a 71-year-old Pennsylvania native who became Neiman’s CEO in 1994 and CEO of The Neiman Marcus Group in 2000—might not grant an interview in any event, because he’s not a fan of personal press.

In August, writer Diana Kunde asked for a half-hour interview with Tansky specifically for this story, e-mailing her request to Neiman’s spokeswoman Ginger Reeder. “I would like to interview [him] … about the steps the company is taking to ensure liquidity and tantalize up-market shoppers back into buying, as well as his current take on the recovery of this market,” Kunde wrote.

Reeder replied the same day.

“Typically we do not discuss our marketing plans as they are proprietary, nor are we willing to make predictions about the recovery of this market,” Reeder said in an e-mail. “I will see if there is any reason to make an exception in this case, but we are most likely not going to be able to discuss anything that was not covered in our last earnings call. Mr. Tansky is currently on vacation and unavailable for an interview, but I will let you know if there is someone else available.”

We never heard anything more about an interview. But apparently, Tansky is not always so opposed to personal press.

The Neiman’s chief found time to be featured in a fall 2009 documentary film about Vogue magazine editor Anna Wintour called The September Issue. At a charity luncheon in Dallas in September, Tansky was overheard asking one of the attendees: “Did you see my cameo?” —Glenn Hunter