In last year’s SMU Cox CEO Sentiment Survey, we wanted to discover if there was light at the end of the long tunnel that was the ongoing economic collapse. Specifically, we sought to determine if area business leaders felt that the economy had hit bottom and was on the path toward recovery. Our conclusion from the survey results was a resounding yes. CEOs felt that there was indeed legitimate reason for optimism. Given the challenges and uncertainty that we experienced in the ensuing year, for 2010, we wanted to determine whether the light that respondents saw last year was a glimmer of hope—or a fast-approaching train ready to derail our fragile recovery.

During the last couple of years, our nation has lived through some of the most turbulent economic times in memory. However, while the recession slowed the migration of people to states like Arizona, Nevada, and Florida, Texas and the Dallas-Fort Worth region have fared much better. For the fourth straight year, Texas maintained its position as the state with the largest population gain. DFW’s general business mood also improved in 2010, although the impact of the economic downturn continues to linger. We went into the recession later than the rest of the nation, and we have outperformed the rest of the country in 2010. In fact, halfway through this year, our state had regained half the jobs we lost here in 2009.

So it was, with the recession and changing economic times as a backdrop, that we conducted the 2010 SMU Cox CEO Sentiment Survey. Last year’s results showed a marked turnaround from the pessimistic mood we documented in 2008, during the depths of the economic downturn. Going into this year’s survey, we were curious to see if the optimistic trend continued in the current economic recovery. We also sought to document the impact of the economic downturn on our region’s business leaders and their companies.

IMPACT OF ECONOMIC DOWNTURN

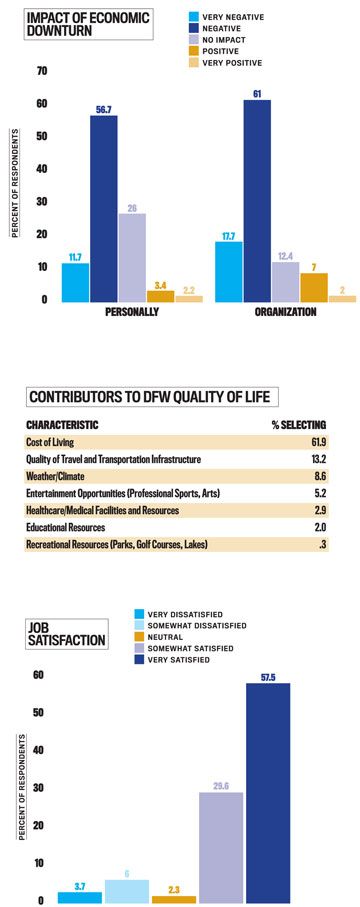

Much has been written about the devastating toll that this recession has had on households and businesses throughout our country. The number of foreclosures continues to set records, and unemployment levels remain stubbornly high. In this context, we wanted to examine the extent to which business leaders have been directly affected by the downturn. Our survey responses indicated that CEOs in DFW continue to report being personally hit by the downturn, and the statistics almost mirror those of last year. This year, 68 percent of respondents reported a negative or very negative personal impact, compared to 70 percent in 2009. For their organizations it was an even rougher year, with 78 percent of CEOs citing a negative or very negative impact on their businesses—a 3 percent increase from 2009.

In light of this negative impact, we asked respondents how much change their organizations had undergone as a result of the downturn. A solid majority indicated that their organizations have undergone minor (26 percent), moderate (34 percent), or significant (31 percent) changes as a result of the downturn. Only 3 percent reported that their organizations have undergone a complete transformation. When asked if current conditions represent an improvement or a deterioration of the economic environment, 44 percent reported seeing an improvement, compared to 34 percent who reported experiencing a decline. As a consequence, CEOs expect to enact further changes in their organizations in the year ahead, with 35 percent expecting these changes to be minor, 37 percent expecting moderate changes, and 21 percent planning significant changes. Almost half of our respondents (47 percent) indicated that the continuation of the current economic climate is one of their top three business challenges for 2011. Changing customer needs and expectations as a result of the crisis (13 percent) and legal/regulatory issues (14 percent) rounded out the rest of the top three business challenges going forward.

ECONOMIC AND BUSINESS OUTLOOK

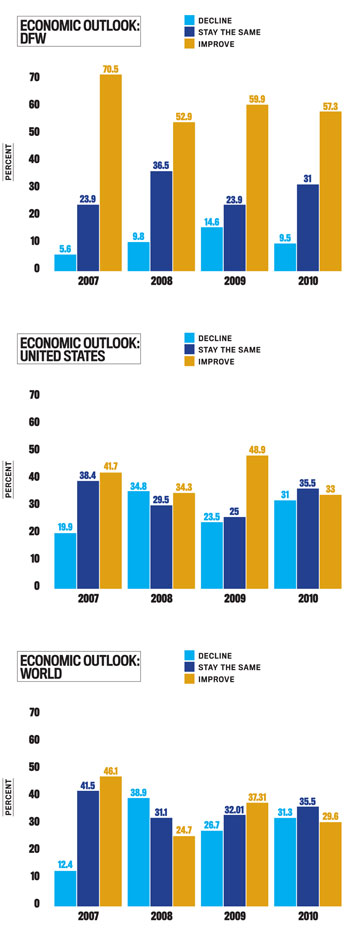

The primary goal of the SMU Cox CEO Sentiment Survey is to put our finger on the pulse of DFW business leaders to get their perception of where business and the economy are headed in the coming year. When asked about their outlook for the world economy over the next 12 months, we observed a fairly clear three-way split among our respondents. Slightly more than 35 percent expect the world economy to stay the same, 30 percent think it will improve, and 31 percent believe we will see a decline. CEOs believe the U.S. economy will respond in almost the same way, with 35 percent expecting it to remain the same, 33 percent forecasting improvement, and 31 percent expecting a decline. As usual, the Texas “can-do” spirit was displayed in the projections for the DFW region. More than half (57 percent) foresee improvement in our region’s economy, with 31 percent predicting conditions in our area to remain the same, and only 10 percent anticipating a decline.

These results represent a slight change from last year’s more optimistic appraisal. The outlook of the area’s business leaders has clearly dimmed a bit and suggests that the current economic recovery is still fragile. However, the CEOs’ outlook has not returned to the levels that we saw in 2008, when 39 percent expected a decline in the world economy and 35 percent expected the U.S. economy to falter. Interestingly, confidence in DFW’s economy has always been strong, never dipping below 53 percent expecting improvement.

OUTLOOK FOR THEIR BUSINESSES

The outlook of our CEOs for their own businesses over the coming year is decidedly mixed. On the positive side, we see an improvement in the percentage of respondents expecting an increase in revenue over the next 12 months compared with last year (58 percent this year versus 46 percent in 2009). However, a higher percentage of respondents also expect that costs will increase over the next 12 months (58 percent this year versus 46 percent in 2009). The net effect is a slight uptick in the percentage of CEOs that expect to see increases in profits in the year ahead (47 percent this year versus 44 percent in 2009). Not a huge turnaround, but certainly a trend in the right direction. The trend in the percentage of CEOs expecting a decline in profits is also encouraging (31 percent this year, compared to 38 percent who expected a decrease in last year’s survey). Although some of the expected increases in profits will be driven by revenue growth, productivity gains will also play a significant role. Slightly more than half (52 percent) of our respondents expected some increases in productivity (29 percent expecting productivity increases greater than 5 percent), while only 12 percent expect a decrease in productivity.

On the expenditures side, CEOs are expecting small increases across a number of categories. Although capital expenditure budgets will remain flat in 44 percent of our respondents’ organizations, they are predicted to increase in 34 percent of them. CEOs also see staffing levels remaining relatively flat (48 percent expect no changes) while 32 percent project increases. Employee pay is set to increase in 48 percent of the companies represented in our sample while remaining flat for 43 percent of them. Seeing the value in employee training and development (and perhaps their role in increasing productivity), 58 percent of CEOs expect to keep training budgets the same over the next 12 months, while just 13 percent will enact cuts in this category.

The sustained success of an organization depends on the quality and depth of its leadership bench. When asked to rate how many leaders in their organizations were ready to “step up,” our CEOs rated their leadership bench depth as either excellent (26 percent) or good (53 percent). Most of these organizations develop or grow their own leaders internally (62 percent), while 30 percent employ both grow and buy strategies for leadership development in equal proportions. Interestingly, only 39 percent of business leaders responding to our survey indicated that their organizations had a formal succession plan in place. (Recently, a prominent DFW company found out how critical this need is when it was suddenly forced to replace its CEO, with no apparent internal candidates from which to choose.)

TROUBLING ECONOMIC TIMES

Always test the strength of business leaders. When asked to identify the top three challenges they face as CEOs, respondents listed the following: maintaining a sustaining competitive advantage (64 percent), attracting and retaining good employees (40 percent), and managing crises (30 percent).

Other challenges that occupied their attention included: meeting quarterly earnings projections (28 percent), maintaining brand integrity (25 percent), getting accurate data for decision-making (22 percent), and complying with regulatory and legal requirements (16 percent).

LEADING THROUGH TOUGH TIMES

Given the myriad challenges they face in their roles, we asked CEOs to identify the critical traits or characteristics needed to meet these challenges. When asked to identify the top three attributes or skills that most contribute to a CEO or president’s success, our respondents listed the following: sound decision-making (64 percent), strategic thinking (49 percent), and strong ethics (44 percent). They also believe that being a good judge of people (28 percent), and having good interpersonal skills (27 percent), negotiation skills (18 percent), and courage (16 percent), are important.

Reflecting on their own performance, we asked respondents to list the top three indicators they use to measure their personal success. With all the recent media reports about CEO compensation, one might expect the leaders to overwhelmingly place compensation at the top of the list. It did make the list, but was cited by only 14 percent of CEOs. Instead, the CEOs cited their company’s success (79 percent), followed by having a personal impact on the lives of employees and customers (59 percent), and the amount of time spent with loved ones (41%).

All who serve in leadership positions know it can be lonely at the top. So it’s the presence of those important confidants in one’s life that can make all the difference. Who do our leaders consider to be their most important advisers? The most commonly listed confidants were their spouse (72 percent), a personal friend (49 percent), and their chief financial officer (33 percent).

In spite of the challenges faced when leading organizations in the modern age, we found that CEOs continue to express the same high level of job satisfaction and security we have found over the past four years. More specifically, 58 percent of CEOs reported being very satisfied with their jobs, while 30 percent said they were somewhat satisfied. Only 4 percent reported being very dissatisfied with their current leadership roles. Also, despite the high volatility in today’s business environment, 60 percent of respondents indicated feeling very secure with their jobs, and 15 percent stated they were somewhat secure. Job insecurity was an issue for only about 17 percent of respondents.

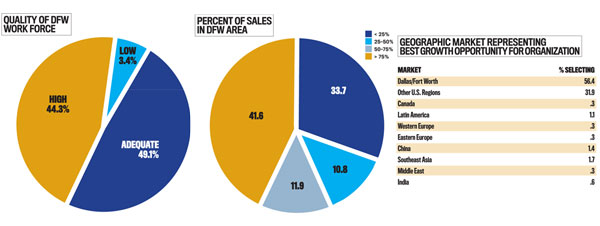

RATING THE DFW AREA

The DFW area continues to be a critical market for local companies. Of our respondents, 40 percent listed DFW as the source of 75 percent or more of their revenue. This is up slightly from 39 percent in 2009. More than 55 percent also indicated that the area represents the best growth opportunity for their company in 2011. When asked to rate the quality of our area’s labor force, 48 percent felt it is adequate, while 43 percent rated it as high. These results are encouraging, as a qualified labor force is one of the key components of a positive business climate.

We also asked CEOs to rate the factors that they felt contributed to our area’s quality of life. Cost of living (60 percent), quality of the travel and transportation infrastructure (13 percent), weather (8 percent), and entertainment opportunities (5 percent) were the key factors cited by respondents. When asked what local governments could do to help businesses, 39 percent cited increasing financial incentives (such as tax rebates), while 31 percent believed the public school system needed improvement. In fact, improving public education has been a stated need in our survey for each of the last four years. At least one major business supporter, the Greater Dallas Chamber of Commerce, has decided this need is so important that it recently called for businesses to step up to the plate in aiding the educational process. In announcing a strategic plan to attract to Dallas companies that are in skilled growth industries like technology and health, the chamber also cited a goal to raise high school graduation rates from 67 percent to 80 percent, and advanced degrees from 10 percent to 15 percent, by 2015.

ETHICS AND SOCIAL RESPONSIBILITY

We were interested in following up on a new set of questions added to last year’s survey dealing with ethical behavior and an organization’s social responsibility. Given the role that ethical lapses played in our recent economic decline, we asked respondents whether or not their organizations had a formal ethics program in place. Slightly fewer than half (49 percent) indicated that such a program existed in their organizations. For those with established programs, we asked about the types of initiatives that had been enacted. The responses showed the following are in place: an ethics office (4 percent), an ethics officer (8 percent), a statement of values (33 percent), a code of ethics (36 percent), required ethics training (18 percent), channels for reporting violations (18 percent), a whistle-blowing policy (10 percent), active monitoring of ethics violations (16 percent), and ethical behavior as a component of employee performance reviews (4 percent).

When asked about the role that social responsibility played in their organizations, 35 percent indicated it played an important role, while 32 percent said it was very important (just 10 percent said it was unimportant). In fact, 54 percent of our respondents stated that they had incorporated one aspect of social responsibility, sustainability, into their formal business plans. When asked to indicate the specific sustainability initiatives present in their organizations, CEOs indicated the following: moving toward being a paperless organization (34 percent), recycling (35 percent), LEED certification for buildings (10 percent), reducing greenhouse emissions (6 percent), carbon tracking (2 percent), water purification (5 percent), package reduction (6 percent), energy generation (6 percent), and water purification (5 percent). Our region’s businesses appear to be going “green.”

CONCLUSIONS

This year’s survey finds that DFW business leaders have become slightly more pessimistic in their outlook about the world and U.S. economies compared to last year. However, their outlook is still far more positive than it was in 2008, when sentiments hit their lowest level in the four-year history of the SMU Cox CEO Sentiment Survey. CEOs are still very optimistic about the prospects for the DFW area and expect their organizations to piggyback on this growth. We were relieved to see that respondents didn’t seem to be contemplating any large-scale labor cuts and, in fact, plan on increasing payrolls slightly. Continued investment in their organization’s human capital through training and development bodes well for future sustainable growth, given the established links between these types of investments and organizational performance.

Education seems to be a critical issue that could threaten to derail our region’s growth and prosperity. Although our respondents see our current labor force as being of adequate or high quality, companies contemplating a move to our area need to be convinced that the educational system will continue to produce a quality labor force. Release of the movie Waiting for Superman has brought this issue into sharper focus, and we expect to see more initiatives aimed at improving our educational system in the coming years. In fact, SMU’s own Simmons School of Education and the Bush Institute have recently launched programs to develop education leaders focused on improving student outcomes.

So, was last year’s light at the end of the tunnel an oncoming train? Our conclusion is that it depends on which tunnel you are talking about. The DFW tunnel appears to have a light of optimism inside. The light in the tunnel to the rest of the world seems far more threatening. Let’s hope that it is just the light of a maintenance worker fixing the rails en route to a sustained recovery.

PROFILING THE RESPONDENTS

We are grateful to the 359 DFW business leaders who responded to this year’s survey. As usual, this was a very experienced group of leaders with more than 10 years of experience as CEO or president of their current company (72 percent) and over the course of their careers (80 percent). Our sample was overwhelmingly male (90 percent) and white (89 percent). The majority had a bachelor’s degree (47 percent), with an MBA (17 percent) representing the next most common degree. General management was the most common functional background (33 percent), followed by sales (14 percent), finance (9 percent), and operations (9 percent). Finally, most were between 50 and 59 years of age (42 percent) followed by 60-69 years of age (31 percent).

Our respondents lead organizations representing DFW’s full economic landscape. The vast majority led private organizations (88 percent) with annual revenue of $50 million or less (83 percent) and fewer than 100 employees (73 percent).

Surveys were completed either online or in paper form during September 2010. For more information about the SMU Cox CEO Sentiment Survey, and to register to receive next year’s survey, please visit www.coxceosurvey.org.