When we conducted the SMU Cox CEO sentiment Survey this time last year, Lehman Brothers had just failed and various bailout packages were being considered. The CEOs we surveyed reflected the rising pessimism by reporting significantly lower expectations for the overall economy as well as for their respective businesses when compared to the 2007 survey. However, nobody was quite prepared for the economic tsunami that was washing over the U.S. and world economies at that time. In August of 2008, the national unemployment rate stood at 6.1 percent, with the Dallas-Fort Worth area registering a modest 5.1 percent rate. Fast-forward one year later, to August 2009, and the national unemployment rate had risen to 9.7 percent, with the DFW area rate at 8 percent. In the intervening year we have elected a new president and have witnessed the collapse of the auto industry and the housing market and the ballooning of the federal deficit. Through it all, the DFW area seemed very distant from the free-fall experienced by communities from Michigan to Florida to California. Recently there has been increasing talk of a bottoming out, with some economists proclaiming the Great Recession over and others speaking of “green shoots” sprouting up across the economic landscape.

It is in this context that we set out to collect responses for our third annual SMU Cox CEO Sentiment Survey. We were curious to see if the lowered expectations reported last year had been replaced by rising optimism of better times ahead. We were also interested in finding out how the Great Recession had impacted our area’s business leaders personally, as well as the organizations they led. As before, we also sought to assess the personal and business challenges faced by CEOs across the DFW metro area and their views about what makes our area a great place to do business. So it was with great anticipation that we tabulated the 528 responses that we received to this year’s survey. The results paint a picture of not only personal and business hardship, but also of the enduring spirit of optimism that has become the hallmark of our area. Here is what we found.

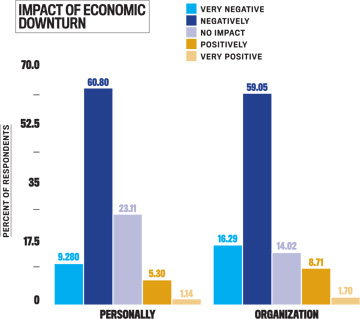

In addition to the usual questions from past surveys, this year we added several questions dealing specifically with the financial meltdown and the ensuing economic collapse. When asked how the economic downturn had impacted them personally, 70 percent reported that the downturn had affected them negatively or very negatively. Although this is not surprising given the collapse in the value of most asset classes, it does reinforce the fact that very few escaped this downturn unscathed. When asked about the impact on their organizations, a staggering 75 percent reported a negative or very negative impact.

Much has been written about the causes of the financial meltdown that resulted in the economic downturn. Explanations have ranged all the way from government and regulatory mismanagement to incentive structures that rewarded excessive risk to something closer to our heart: the training of MBA students. Thus, we were curious to hear from our CEOs about what they thought were the primary causes of the meltdown. We asked respondents what they thought were the top two causes of the meltdown. By a wide margin, our respondents blamed greed as the primary cause for the collapse, cited as a top-two reason by 43.4 percent of our respondents. Poor regulatory oversight was the next most common reason cited, selected in the top two by 37.3 percent of respondents. Incidentally, we were pleased to see that less than half of a percent of our respondents (0.2 percent, to be exact) thought that the way business schools had been training their MBA students had anything to do with the collapse.

Our goal in launching this survey was to put our finger on the pulse of DFW area business leaders to see where they thought things were going in the coming year. Thus, the heart of our survey is the respondents’ economic outlook for the world, U.S. and DFW area. With three years of data under our belt, we now have some basis of comparison for the responses that we received and are able to put these responses in a longer-term context.

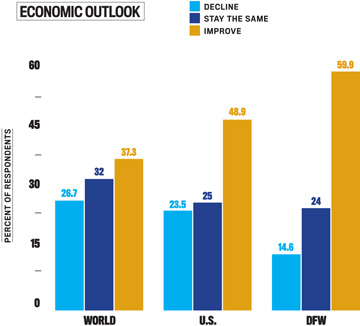

When asked about their outlook for the world economy, more respondents expect an improvement (37.3 percent) than a decline (26.7 percent). This stands in stark contrast to last year’s results, when expectations of a decline exceeded those for improvement by a 14 percent margin. In terms of the U.S. economy, a vast majority of respondents expect an improvement (48.9 percent) with only 23.5 percent predicting a further decline. Last year, respondents were evenly split in their outlooks for the U.S. economy. Our respondents are even more optimistic about the economic outlook for DFW, with an outstanding 59.9 percent expecting improvement and only 14.6 percent expecting a decline.

Once again, our respondents are much more optimistic about the prospects for our immediate area than they are about the country as a whole. Interestingly, this was the first year that the outlook for the overall U.S. economy was worse than for the rest of the world. Also, even though our results reflect a marked turnaround from last year’s gloomy outlook, the level of optimism for the world and DFW economies is still below what we found in our 2007 survey.

Our CEOs’ expectations regarding the performance of their own organizations were not so rosy, however. Specifically, the percentage of respondents who expected their revenues to increase has gone down steadily from a high of 80 percent in our 2007 survey to 46.4 percent this year. Conversely, the percentage expecting their organization’s revenues to decrease has gone up from a low of 6.2 percent in 2007 to 33.5 percent this year. The percentage expecting revenues to stay the same has remained surprisingly steady over the past three years and currently sits at 15.5 percent. The same pattern can be found when we asked CEOs about their profit expectations in the coming year. The percentage of CEOs expecting an increase in profits has shrunk from a high of 62 percent in 2007 to 44.1 percent in the current survey. Alternately, those expecting a decrease in profits have increased from 15 percent in 2007 to 38.3 percent in this year’s survey. The only bright spot in our survey concerns organizational costs. The percentage expecting an increase in costs has decreased dramatically from a high of 76.3 percent in 2007 to 46.4 percent this year. Conversely, those expecting their costs to decrease have gone up from 5.5 percent in 2007 to 24.2 percent in 2009.

Digging deeper into the nature of their operations, we asked CEOs to discuss their expectations for productivity, staffing levels, pay, and training over the coming year. The vast majority of CEOs responding to our survey expect productivity to remain the same (27.1 percent) while more than half (51.3 percent) expect it to increase. Given the substantial job losses experienced over the past year, it is perhaps comforting to know that the vast majority of CEOs expect their staffing levels to remain the same (42.6 percent) or actually increase (29.3 percent) over the coming year. Of course this still leaves 25.9 percent of respondents who expect their staffing levels to decrease over the coming year. Employees can expect relatively flat pay levels over the coming year. Nearly half (48.1 percent) of the CEOs who responded to our survey expect pay levels to remain the same over the coming year, while 37.6 percent expect modest increases (31.3 percent of these expect raises to be less than 5 percent). Our CEOs still believe in the importance of investing in their human capital, with 50.4 percent expecting training budgets to remain the same and 21.4 percent expecting increases. Capital expenditures are more mixed, with 32.2 percent expecting decreases (17.2 percent of these expecting decreases greater than 10 percent), 33.5 percent expecting flat capital budgets, and 31 percent expecting an increase.

The picture that emerges from these economic and organizational expectations is one of guarded optimism. The downward trend we saw from 2007 to 2008 has generally reversed. However, there does not appear to be a huge employment or capital spending boom on the horizon. Employees can expect more of the same in terms of pay and training but increased productivity expectations.

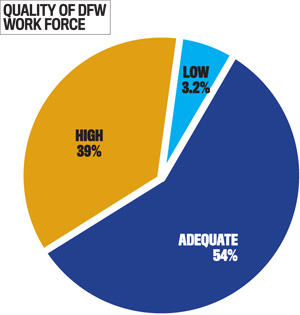

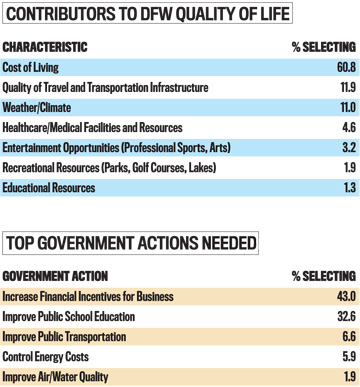

Our area has become a magnet for corporate relocations. Most recently, AT&T relocated from San Antonio to Dallas and many other smaller firms are following suit. Our survey seeks to track the qualities that make the DFW area attractive for organizations. Not only is the DFW area attractive as a place to set up shop, but it also represents a very robust market in which to sell goods and services. In fact, the DFW area accounted for 75 percent of the sales in 39 percent of our respondent firms. When asked to rate the factors that contribute to the quality of life in our community, 60.8 percent cited cost of living as most important followed by quality of travel and transportation (11.9 percent) and weather (11 percent). However, as we have seen with some of the Rust Belt cities, businesses can also leave a city so local governments must constantly adapt in order to retain the businesses in the area and attract new ones. When asked what local governments should do to improve the business climate in the DFW area, our respondents rated increasing financial incentives for businesses as their top concern (cited by 43 percent of respondents). Rounding out the top three, our CEOs rated improving public schools (32.6 percent) and improving public transportation (6.6 percent) as other top priorities for elected officials to address.

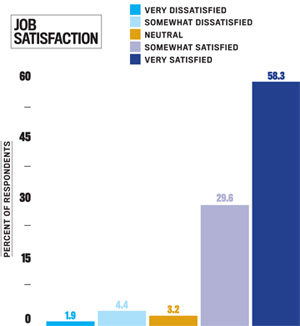

Leadership is a quality that is most needed in difficult and uncertain times. Thus, the responses to our leadership questions this year were of particular interest to us given the current economic crisis. For example, we expected CEOs to report lower levels of job security and satisfaction as a result of this turmoil. Surprisingly, the results of this year’s survey mirror almost exactly those of 2007 and 2008, with 76.4 percent saying they felt either somewhat or very secure in their jobs and an incredible 87.9 percent reporting that they were somewhat or very satisfied with their jobs.

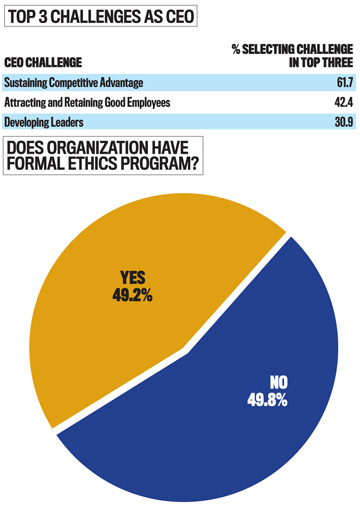

Not surprisingly, the biggest business challenge faced by our respondents was dealing with the current economic climate (cited by 55.7 percent), followed by domestic competition (10 percent) and dealing with regulation or legal issues (7.6 percent). When asked to think about the top three challenges they face as CEOs, they cited sustaining competitive advantage as their top concern (61.7 percent) followed by attracting and retaining good employees (42.4 percent) and developing leaders (30.9 percent). To deal with these challenges, CEOs cited sound decision-making as the most important attribute required (65.5 percent listing it in their top three), followed by strategic thinking (52.8 percent) and strong ethics (45.3 percent).

When our leaders were asked how they defined success, their responses displayed a concern for a variety of valued stakeholders. When asked to list their top three measures of personal success, 76.1 percent selected the success of their company, while impacting the lives of both employees and customers was cited in the top three by 60 percent of respondents. Perhaps reflecting how their personal values were rewarded, the amount of time they can spend with loved ones was selected by 44.1 percent of respondents. Being in control of their time made the top three for 31.4 percent of CEOs, and the number and quality of personal friendships was cited by 18.6 percent.

While tough times dictate tough decision-making, our respondents showed that they have a variety of important confidants with whom they can share. For the third straight year the spouse was elected to the top honor (71.4 percent), and friends (50.4 percent) replaced parents for second place (11.7 percent). The CFO and COO received votes of 33 percent and 30.3 percent, respectively. However, for two years running parents (30 percent) nudged out the spouse (23.5 percent) for being the most influential person in helping our respondents achieve their professional success.

Due to the numerous illegal and unethical events that contributed to the economic troubles of this past year, we included for the first time several questions that asked about programs and policies aimed at promoting ethics and social responsibility in our respondents’ organizations. When asked if their organization currently has a formal ethics program, our respondents were split, with 49.8 percent not having such a program and 49.2 percent having one in place. In listing the initiatives that are a part of their ethics programs, the respondents said that 39.2 percent have a code of ethics, 31.4 percent have a statement of values, 28.4 percent either encourage whistleblowing or have anonymous channels of reporting undesired violations, 26.9 percent use ethical behavior as a component of their employee performance review, 16.5 percent actively monitor ethics violations, and 14.9 percent require employee-ethics training.

In going beyond both the legal and ethical requirements, 88.8 percent of CEOs stated that social responsibility was important to their organization. Finally, our respondents indicated their support of the new greening and sustainability movement. A sizable 54.6 percent indicated their company has integrated sustainability into its business plan. When asked about the specific types of initiatives, the following results were listed: recycling (39 percent), retrofitting facilities to reduce greenhouse gas emissions (10.2 percent), obtaining LEED Certification of buildings (9.7 percent), package reduction (8.5 percent), and energy generation (6.8 percent).

When we launched the SMU Cox CEO Sentiment Survey back in 2007, it looked like nothing could stop the economic expansion that had been going on for nearly a decade, if not longer. However, in just three years, our survey has captured the ups and downs associated with running an organization in a volatile environment. This year we wondered if our respondents see a light at the end of the tunnel or expect the current economic downturn to continue. After tabulating and analyzing the 528 responses received, it appears that a bit of optimism is starting to creep into the minds of our business leaders. What is also clear is that things are not going to return to what they were anytime soon. Organizations are going to be much more cautious with their overall spending and hiring plans. It is going to take every ounce of leadership skill to navigate through this recovery, and we look forward to documenting the journey in our future surveys.

NOTE: If you were not one of the participants in this year’s survey, we invite you to be a part of next year’s survey audience. E-mail your name, title, and both physical and e-mail addresses to [email protected], and we will add you to the list to receive the 2010 SMU Cox CEO Sentiment Survey. Your information will be used for no other purpose.

Industry Percentage

Construction 17.8

Manufacturing 12.5

Financial Services 9.3

Professional Services 7.4

Wholesale Trade 7.2

Retail Trade 6.1

Real Estate 4.4

Energy 2.8

Travel and Transportation 4.0

Health care 3.6

Communications 4.0

Restaurant and Hospitality 2.8

Agriculture .8

Other 13.5

WHO RESPONDED TO THE SURVEY?

This year’s surveys were mailed on Aug. 1, 2009. Respondents had the option of completing the survey electronically or by completing a paper copy. Once again, a large majority chose the paper method.

As with each of our past surveys, the respondents’ composite revealed an interesting profile of the top management ranks in the DFW business arena. Of the respondents who led private companies, the vast majority of our leaders were founders (51.9 percent) and/or owners (67.6 percent) of their organizations. Similar to the proportions in the overall U.S. economy, 84.5 percent of our respondents led privately held companies, 4.9 percent of our CEOs led publicly traded companies, and 4.9 percent led nonprofit organizations. A surprisingly large number of our respondents (66.1 percent) have been at the same company longer than 10 years, with 19.7 percent holding 5- to 10-year tenures.

Our CEO respondents led organizations of many sizes. The vast majority (66.1 percent) were from organizations with 100 employees or less, 23.7 percent led companies with between 100 and 1,000 employees, and 5.3 percent were from companies with more than 1,000 employees. In terms of revenue, the vast majority of our respondents were from companies that made less than $10 million (45.6 percent), or between $10 million and $50 million (33.9 percent). Our respondents represented the vast diversity of industries found in the DFW economy, including construction (17.8 percent), manufacturing (12.5 percent), financial services (9.3 percent), and professional services (7.4 percent). A large majority of our respondents’ companies were started in the DFW area more than 10 years ago (86.6 percent) and have no plans to relocate out of the region (87.9 percent).

In terms of ethnicity, the vast majority of our respondents were white/Non-Hispanic (87.9 percent) males (88.3 percent), with 45.1 percent holding bachelor’s degrees and another 20.1 percent having completed an MBA (12.9 percent) or another master’s degree (7.2 percent). Their functional backgrounds are general management (29.7 percent), sales (15.3 percent), engineering (9.1 percent), operations (8.9 percent), marketing (7.7 percent), and finance (7.2 percent).

Our respondents are tuned into a variety of media outlets to regularly receive information: FOX and The Dallas Morning News both received 56.3 percent of the votes, while The Wall Street Journal (45.5 percent) and the Dallas Business Journal (38.6 percent), CNN (32.6 percent), D CEO Magazine (24.6 percent) and MSNBC (20.3 percent) all had favorable followings.