|

| photography courtesy of Talcott Franklin |

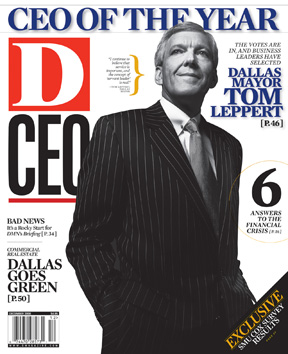

TALCOTT J. FRANKLIN

PARTNER, PATTON BOGGS LLP

Attorney Franklin, an expert in complex financing and intellectual property, has litigated numerous cases related to the sale and/or securitization of commercial and residential mortgage loans, as well as other assets. We wondered about his take on the financial crisis.

1. Did you see this meltdown coming?

Yes. Actually as early as May 2006, I submitted a book proposal that discussed the very issues that are happening today, starting with the bursting of the real estate bubble and the effect that would have with respect to securitization, how that would reverberate throughout the whole system. I was on record then saying that if you look at the fundamentals of the economy, you have to start with its basics: the American family. And the American family was in terrible debt. Someday the bills were going to come due, and we were going to have to pay them. Basically, that’s what happened.

2. Who or what is the main culprit?

Look around, and then look in the mirror. Everybody played some role in this. But at the end of the day, this country became way over-leveraged, and it was justified in the name of homeownership.

3. What about securitization itself?

Securitization was and is a wonderful instrument that can be used very beneficially; it extended credit to a lot of people who previously were unfairly denied credit. However, no instrument is going to work well when it’s over-leveraged, and securitization was part of the over-leveraging.

4. Does the government’s rescue plan have a chance to succeed?

It can’t work by itself, but it has some positive elements to it. For example, it has a transparency provision that says, ‘We’re going to tell you what assets we’re buying, and how much we’re paying for them.’ That can re-start the private market for these instruments and, if that works, then it would significantly increase liquidity. But there are a lot bigger problems waiting to take place than just subprime [home mortgages].

5. Such as?

Credit-card debt right now is at an all-time high. Those defaults are starting to rise, and a lot of that debt is securitized, so the risks are spread around. Auto loans, student loans, and commercial mortgage-backed securities also have issues. In each case, you’ve got significant amounts of leverage out there. You have to worry about that as the economy gets worse.

6. What about long-term ramifications of this mess?

There’s going to be some tightening in the way we all live—in our standard of living, in the way we think about things. Just on the family level, if you can’t afford a house, you shouldn’t buy it, and then also go down to Circuit City and buy a flat-screen television, and then go down to the auto dealer and buy a Mercedes, all of it on credit. That doesn’t make any sense.