People are returning to cities, and the Census has the population data to prove it.

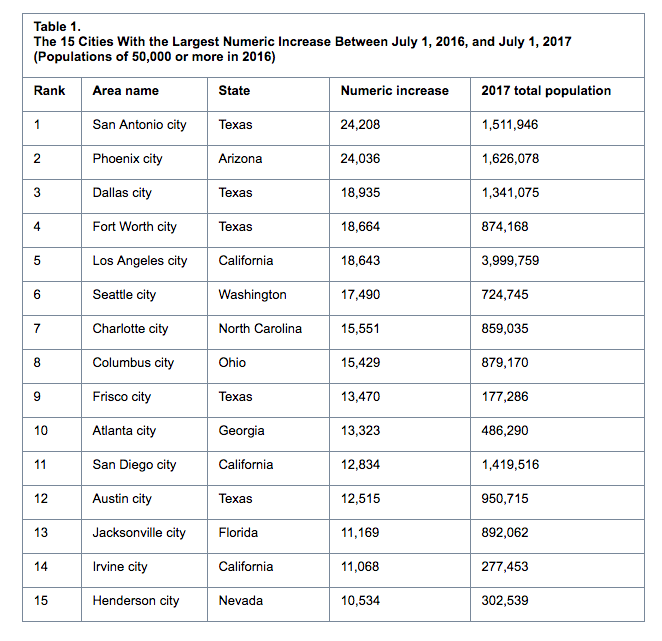

Even Fort Worth, the city that lacks a diverse tax base and is thought to be an afterthought for many corporate relocations, added more people between 2016 and 2017 than all but three other American cities. The kicker: Dallas was one of those. We added 18,935 people, more than anywhere but Phoenix and San Antonio.

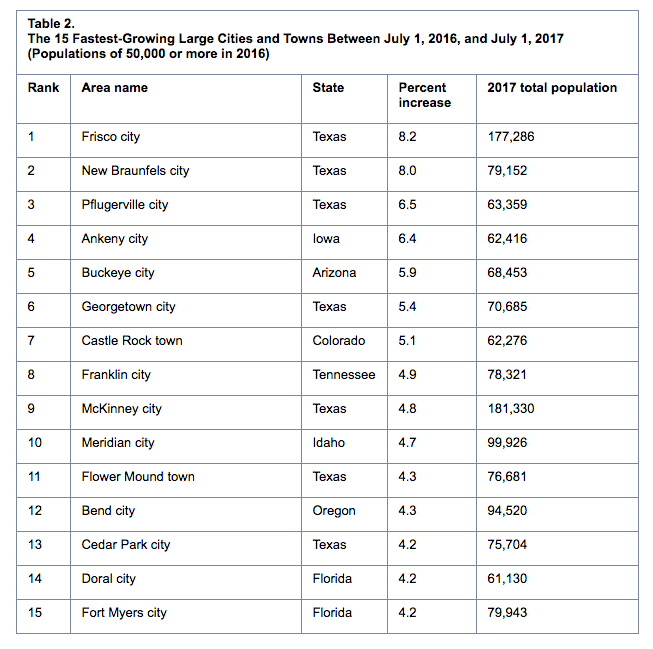

But while the total increases are encouraging, the growth rates still follow the narrative we’ve heard again and again in the past five or so years. The suburbs are far outpacing the region’s biggest cities. Fort Worth increased its population by 2.18 percent. Dallas jumped by 1.4 percent. Frisco, on the other hand, is the fastest-growing city in the country. It leaped forward 8.2 percent, adding 13,470 people to get to a total of 177,286.

Still: the gross increases highlight the return to cities. Frisco is the only suburb to rank among the top 10 U.S. cities in total population increase. San Antonio, Phoenix, Dallas, Fort Worth, Los Angeles, Seattle, Charlotte, and Columbus all added between 24,000 and 15,000 people. Then came Frisco at 13,470, followed by more cities: Atlanta, San Diego, Austin, Jacksonville.

“We are seeing that across the country and, in particular, the Sun Belt, which has plenty of room to rebuild and densify inward,” says Patrick Kennedy, the urban planner and DART board member (and occasional D contributor). “Dallas would not have been on this kind of list in 2010 when our population growth was essentially flat.”

Dallas’ population growth from 2000 to 2010 was just under 8,000 new residents, the majority of which can be attributed to Uptown. That was Dallas’ first real attempt at concentrating density, adding walkability (which is still problematic in many places throughout Uptown), and encouraging a mix of uses. You can see the sort of infill strategy that was so successful in Uptown sprouting all over the city; that it runs parallel with a single-year population increase more than double what was seen in the decade from 2000 to 2010 is not a coincidence, Kennedy argues. (It also helps that our economy is doing very well.)

Fort Worth is seeing that same sort of residual growth in its West 7th district, another high-density neighborhood buttressed by new residential construction. While its downtown lost about 500 people from 2010 to 2016 (from about 5,000 to just below 4,500), West 7th tripled from 904 to 2,706. The city has been particularly aggressive about encouraging mixed-use neighborhoods with urban infill elsewhere, as well. But its tax base is still upside down. Fernando Costa, the assistant city manager, notes that residential property taxes account for 60 percent of the city’s total. Commercial taxes are the other 40 or so percent.

Ratings agency Standard & Poor’s recently dropped the city’s bond rating from AA+ to AA, citing mostly the problems with the municipal pension, but still noted the imbalanced tax base.

“We’re so heavily skewed toward residential that some people fear our worst nightmare will come true and we’ll become a suburb of Dallas, which is the most frightening thought that a Fort Worth resident can have,” Costa said. “I don’t think we’re going to become a suburb of Dallas, but we do need to work on strengthening our economic base and attract more corporate headquarters with higher paying jobs.”

And how he plans to do that? Harness the population spike. Encourage the growth of mixed-use districts, taking the principles of dense infill common in city centers and spreading them to developments elsewhere. Too, Fort Worth isn’t bound by neighboring municipalities the way Dallas is. Its boundaries are expanding outward. Costa mentions the expansion of Alliance in North Fort Worth, the Walsh Ranch development on the west side, and the opportunities surrounding the new Tarleton State University campus to the southwest.

“We have opportunities to create walkable urbanism, even in what are essentially suburban settings,” Costa says. “If we rely on growth through sprawl, we’re going to find that it’s fiscally irresponsible. It doesn’t provide an acceptable return on public investment in streets, water and sewer facilities, police and fire services, parks, and all the facilities and services to support growth.”

So while the suburbs are still growing rapidly, the narrative is beginning to change. The two largest cities in North Texas will need to encourage more of the types of developments that have helped attract so many residents in order to keep pace.

“We can absorb a lot of growth and demand for urban living,” Kennedy says, referring to Dallas. “Let’s just hope we can manage it and design it well.”