When we launched D CEO Real Estate (formerly D Real Estate Daily), we wanted to bring in a team of experts who could write about the industry from their on-the-ground perspectives. We looked for informed thought leaders who also wouldn’t be shy about sharing their opinions. More than five years later, the lineup has grown to more than 95 professionals across all sectors. Want to get the latest on design and urban planning? Read columns by the heads of three top architecture firms: Dan Noble (HKS Inc.), Bob Morris (Corgan), and Don Powell (BOKA Powell). Want to keep up with DFW’s white-hot multifamily market? Look for quarterly reports from Brian O’Boyle of ARA, a Newmark Co. Looking for the latest on development? Hear from Mike Berry (Hillwood Properties), Steve Van Amburgh (KDC), Michael Dardick (Granite Properties), and Bill Cawley (Cawley Partners). Along with returning favorites like Susan Arledge (E Smith Realty Partners), Randy Thompson (Cushman & Wakefield), Brant Bernet (CBRE), and Riis Christensen (Transwestern), the 2017 roster includes new writers like Diane Butler (BBG), Rob Huthnance (Port Logistics Realty), Kourtny Garrett (Downtown Dallas Inc.), and Frank McCafferty (Savills Studley). From Mike Ablon (PegasusAblon) to Steve Zimmerman (The Retail Connection), we’ve got you covered.

Susan Arledge

Managing Director, E Smith Realty Partners

Eight Proven Strategies for Success

From: Sept. 6, 2016

Even when everything else seems stacked against you, effort and persistence can still be your competitive advantages—and they may be the only advantages you truly need. Here are eight proven strategies for success:

Do your most-feared thing first. It’s often the task that can have the greatest impact.

1. Do your most-feared thing first. It’s often the one task that can have the greatest positive impact on your life and results.

2. Take strong stands. Even the most skeptical people tend to be at least partly persuaded by a confident speaker. So be bold.

3. Tap into the power of now. Then do one extra thing.

4. Feed your winners, starve your losers. Stop wasting your coaching time trying to make a bottom producer better; instead, invest that time in making your winning team members even more productive.

5. Learn to be both decisive and to purposefully delay decisions.

6. Learn when to cut your losses. Too many people hang on too long.

7. Write it down. Emmitt Smith, our E Smith Realty chairman, learned a life lesson from Dwight Thomas, his high school football coach in Pensacola, Fla., who told him, “It’s just a dream until you write it down, and then it becomes a goal.”

8. Do what others are unwilling to do. A quote I have on my desk reminds me every day: “Successful people form the habit of doing what unsuccessful people don’t want to do.”

Scott Beck

President and CEO, Beck Ventures

Millennials and Rapid Urbanization

From: Sept. 20, 2016

It’s no secret that “millennials,” defined in 2015 as adults aged 18 to 34, are in the process of reshaping the social, political, and urban landscape of the United States. They now comprise a majority of the labor force (53.5 percent) and, with a population of 75.4 million, the largest American generation.

Millennials are reshaping the urban landscape in the U.S.

The arena in which millennials are effecting perhaps the most palpable, immediate change is the real estate market. They’re eschewing home ownership, with some choosing to live with their parents and others seeking an urban environment that offers public transit and a lot of entertainment options. North Texas cities are recognizing this trend and working with developers to subsidize and accelerate mixed-use growth. Plano, for example, has Legacy West, a $3 billion mixed-use development that features hudreds of apartments and a series of new shops and restaurants. The city of Dallas is working with local developers to facilitate mixed-use development near downtown and in Dallas Midtown. The new Park District project along Klyde Warren Park will be anchored by a big lease from PwC, whose move is designed to cater to its millennial employees.

DFW is projected to add 3 million more residents by 2030, and urban growth will continue to characterize the region’s real estate market for the foreseeable future.

Ran Holman

Dallas Market Leader, Cushman & Wakefield

Dallas is Growing Up

From: Sept. 22, 2016

Firms like Google, Facebook, and Apple have taught us that office environments, to be desirable, have to do more than their designed function. There is now an experiential component to environments requiring them to be more than what they are. This can mean a lot of things.

Dallas is no longer “Fly over” territory. It is a legitimate player on all levels.

In Uptown, we’re seeing a financial district unfold, with the Ritz being the center of that universe. That confluence of amenities, parks, arts, sports, the trolley, and general coolness, make this area unique and defined. Most companies considering Uptown know exactly what they want, and they are willing to pay for it. A happy employee is typically a productive one, and a few extra bucks in rent pales in comparison to payroll.

But this “urbanism” is not restricted to traditional urban environments. What we are seeing in Legacy and Legacy West in Plano is another example of the sum of components being greater than its parts. Same with the micro market of Preston Center. In these markets we are seeing the highest rents, lowest vacancies, and lowest cap rates. It is no mistake. These areas are easy to get your mind around. Their energies are palpable.

Corporations are taking note, and so are investors. Dallas is no longer “fly over” territory. It is a legitimate player on all levels of the commercial real estate business.

Tim Hughes

President and CEO, Falcon Realty Advisors

Practicing Conscious Capitalism

From: May 11, 2016

Conscious capitalism is a business model with a mission to inspire, educate, and engage with all stakeholders. I was introduced to the philosophy a long time ago, but it has taken years to see its full-circle impact. What began as a desire to give back to the community has grown into a holistic relationship between Falcon Realty and the communities we serve.

Some people may believe the real estate industry does not always appreciate the impact land development may have on the environment or community, and a business can’t possibly have both a positive impact and also be profit-driven. Although it is a lofty goal, I believe that an intersection can be accomplished by incorporating “conscious capitalism” business practices.

I was introduced to the philosophy a long time ago, but it has taken years to see its impact.

Two companies that have mastered the art of this are Whole Foods Market and Trademark Property Co. Partnering together, they’ve created the first ground-up “conscious place” known as Waterside in Fort Worth.

At our company, practicing conscious capitalism includes not centering our purpose on the amount of deals we are working on, but on supporting and elevating the brands we represent and the communities we serve. My goal has been to not only turn Falcon into a conscious company, but build and maintain relationships with companies that also practice these principles.

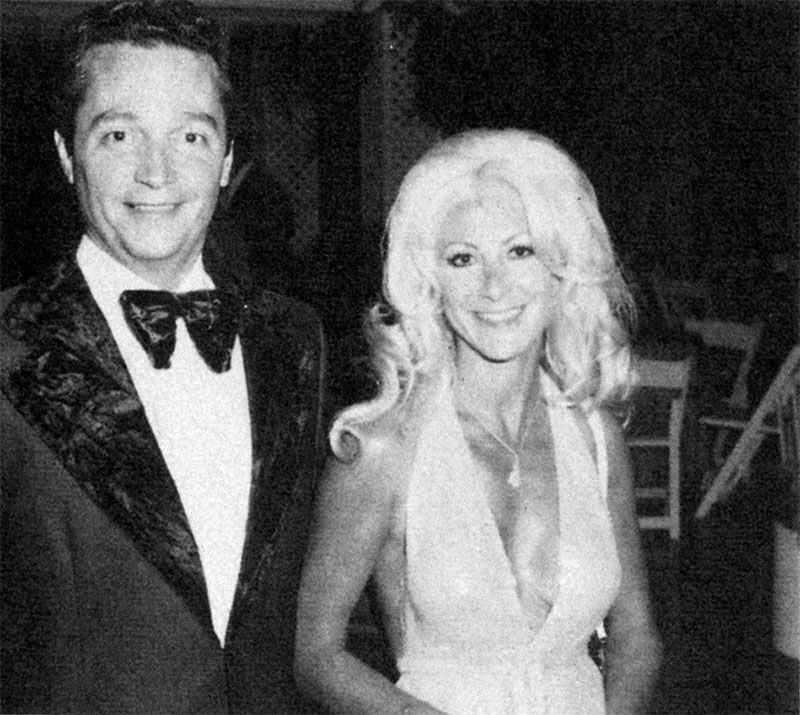

Linda McMahon

Linda McMahon

President, The Real Estate Council

Bringing the Middle Class Back to Dallas

From: March 30, 2016

The city of Dallas and its partners have made great strides toward positioning the community for robust growth. But if we are to experience long-term economic strength, city leaders must now adopt mixed-income housing policies that will attract the forgotten middle class back to the city.

There is a severe deficit of [housing] options for the middle class.

Growing demand for housing in the region has resulted in Dallas having the highest rental rates in Texas. Additionally, fewer opportunities for middle class home ownership are exacerbating this rental squeeze. Although there is a severe deficit of options for the middle class, there are essentially no policy tools or funding streams available to help them secure affordable housing. This housing crisis is a complex issue, and it’s one that The Real Estate Council members have been studying for more than four months. After a comparison of the housing policies from 17 peer cities across the nation, our members determined the best ways to tackle the issue is to develop policies that will facilitate the creation of mixed-income housing. Recommendations include creating new sources of funding for the creation of affordable housing; a review of existing zoning policies to allow greater density; and creation of a Housing Trust Fund and a Land Trust. We firmly believe these recommendations will expand housing options.

Brian O’Boyle

Vice Chairman, ARA, A Newmark Co.

Shifts in DFW’s Multifamily Market

From: November 1, 2016

During the last few months, the multifamily market has been witness to significant changes. Right now, buyers seeking properties in the Class A sector have an abundance of choice and, as a result, have become much more selective in their offer process. In the conventional “best and final” process, we are seeing a reduction in the number of participants. A year ago, six or seven potential buyers participating in the best and final round was the norm; today, that number is closer to three or four.

Buyers in the class A sector have become much more selective.

The underwriting process has also changed. Buyers are generally underwriting deals more conservatively. Even so, brokers are typically achieving their strike price—they are just having to work a little harder. Unfortunately, there has also been an increase in the number of deals that are falling out of escrow, with brokers having to opt for their second choice in the buyer pool.

That being said, Class B and Class A communities that have a strong value-add component continue to receive strong interest across the sector. Furthermore, we have seen substantial appreciation in the Classes B and C market and still frequently see new high-water marks set. The North Texas job growth story helps mitigate some of the concerns about the robust new construction pipeline, and Dallas continues to find itself on more buyer radar screens.

2017 Contributing Editors D CEO Real Estate

Mike Ablon

PegasuAblon

Marc Allen

Transwestern

Jon Altschuler

Altschuler and Co.

Susan Arledge

E Smith Realty Partners

Dan Avnery

NAI Robert Lynn

Randy Baird

Cushman & Wakefield

Scott Beck

Beck Ventures

Eric Beichler

Mohr Partners

Brant Bernet

CBRE

Mike Berry

Hillwood Properties

Walt Bialas

JLL

Anthony Bolner

Stream Realty Partners

Cliff Booth

Westmount Capital

John Brewer

Transwestern

Bill Brokaw

Hillwood Properties

Linda Burns

Burns Development Group

Bill Burton

Hillwood Urban

Diane Butler

BBG

Kim Butler

Hall Group

Bruce Carlson

CMA

Bill Cawley

Cawley Partners

Riis Christensen

Transwestern

John Conger

Colliers International

Brian Cramer

Newland Communities

Steve Crosson

Capright

Peggy Daly

Monogram Residential Trust

Chuck Dannis

National Valuation Consultants

Michael Dardick

Granite Properties

Steve Everbach

Colliers International

Collin Fitzgibbons

KDC

Celeste Fowden

CBRE

Rob Franks

JLL

Lisa Gardner

OMS Strategic Advisors

Kourtny Garrett

Downtown Dallas Inc.

Mike Geisler

Venture Commercial Real Estate

Jack Gosnell

CBRE | UCR

Robert Grunnah

Novus Realty Advisors

Karra Guess

E Smith Realty Partners

Allen Gump

Colliers International

Susan Gwin Burks

Colliers International

Ran Holman

Cushman & Wakefield

Tim Hughes

Falcon Realty Advisors

Rob Huthnance

Port Logistics Realty

Ryan Johnson

SRS Real Estate Partners

Craig Jones

JLL

Sam Kartalis

Novus Realty Advisors

Justin Keane

Wynmark Commercial

Blake Kendrick

Stream Realty Partners

Beth Lambert

Cushman & Wakefield

JJ Leonard

Stream Realty Partners

Steve Lieberman

The Retail Connection

Tanya Little

Hart Advisors Group

Torrey Littlejohn

JLL

Terrence Maiden

Corinth Properties

Frank McCafferty

Savills Studley

Linda McMahon

The Real Estate Council

Rick Medinis

NAI Robert Lynn

Marshall Mills

The Weitzman Group

Terry Montesi

Trademark Property Co.

Bob Morris

Corgan

Charlie Myers

MYCON General Contractors

Lauren Napper

Cushman & Wakefield

Dan Noble

HKS Inc.

Brian O’Boyle

ARA, A Newmark Co.

Kathy Permenter

Younger Partners

Ian Pierce

The Weitzman Group

Jennifer Pierson

Pierson Retail Advisors

Don Powell

BOKA Powell

Jeff Price

JLL

Emily Rankin

Transwestern

Ari Rastegar

Rastegar Equity Partners

Mark Reeder

SRS Real Estate Partners

Ken Reese

Hillwood Urban

Andrew Schendle

Hunt Construction

Alan Shor

The Retail Connection

Paul Smith

Velocis

Eliza Solender

Solender/Hall Inc.

Jo Staffelbach Heinz

Staffelbach

Chris Summers

Xceligent Inc.

Tom Sutherland

Colliers International

Chris Teesdale

Colliers International

Steve Thelen

JLL

Randy Thompson

Cushman & Wakefield

Sanders Thompson

Transwestern

Steve Van Amburgh

KDC

David Walters

CBRE

Michael Walters

Falcon Realty Advisors

Herb Weitzman

The Weitzman Group

King White

Site Selection Group

Steve Williamson

Transwestern

Craig Wilson

Cushman & Wakefield

Jim Yoder

Velocis

Bob Young

The Weitzman Group

Moody Younger

Younger Partners

John Zikos

Venture Commercial Real Estate

Steven Zimmerman

The Retail Connection

This article appears in D CEO’s Real Estate Annual 2016 issue.