An overnight success rarely happens overnight. For years, a small group of passionate business and civic leaders has been touting the virtues of the core of downtown Dallas. Now suddenly, it seems, the world has taken notice. Suburbanites are driving in to catch a show or enjoy a meal at a hot new restaurant. New residents are snapping up apartments and lofts. Downtown hotels such as the NYLO Dallas and Omni Dallas are bustling.

“It’s stunning to see,” says Jack Gosnell, senior vice president with CBRE|UCR in Dallas, whose brokerage firm is involved in leasing retail space in projects such as The Olympic at 1401 Elm St., McKinney & Olive in Uptown, and the Dallas Farmers Market. “People are starting to look at Dallas differently now.”

Real estate investors have taken notice, too. Buildings that have sat vacant for decades are being acquired by buyers from around the globe, sparking an unprecedented revitalization and adaptive reuse boom. It’s a far cry from where things stood in the late 1990s, when Ted Hamilton bought the Davis Building, a 1926 landmark on Main Street. Back then, there were fewer than 400 residential units in the central business district. When the Davis Building reopened a few years later with 183 units of loft apartments, a large parking garage, and 52,000 square feet of retail space, there were still only about 900 residential units downtown, says Hamilton, president of Dallas-based Hamilton Properties Corp.

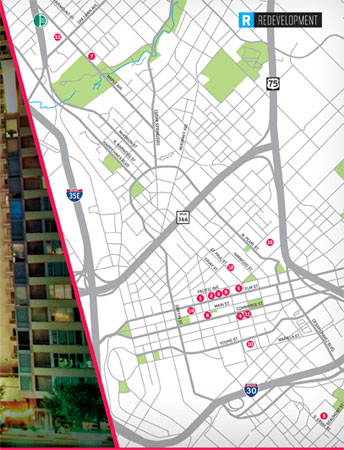

The success of the Davis Building led Hamilton to tackle a number of other redevelopment projects, including Aloft Dallas Downtown, DPL Flats, Lone Star Gas Lofts, and Mosaic. His latest effort involves turning a 12-story building just south of City Hall into a 237-room Lorenzo Ascend Hotel. “Redevelopment is a lot harder than new construction, so most large developers don’t want to mess with it,” Hamilton says. “It takes so much more time, energy, and effort that there’s only mostly entrepreneurial guys interested in doing it in the first place.”

SOUTH SIDE STAR

Another urban trailblazer is Jack Matthews of Matthews Southwest. His redevelopment of a former Sears warehouse into the wildly successful South Side on Lamar helped spark the creation of a new submarket just south of downtown Dallas. Matthews has gone on to develop nearly 2 million square feet of space in the neighborhood, with projects such as a 164-unit apartment community on Belleview Street, a 75-unit condominium development called The Beat, The Cedar’s Social restaurant, a 45-lot urban housing project with David Weekly Homes, a 290-unit residential complex at 1210 S. Lamar St., and the Alamo Draft house, which is set to open later this year.

“What we’ve learned is the less you do, the more people like it,” Matthews says. “They like things like exposed brick.”

Matthews’ newest target is the former Dallas High School. Built in 1907 on the eastern edge of downtown at Pearl and Bryan streets, it has been unoccupied since the 1990s. Matthews and developer Mitch Paradise initially plan to convert the property into office space. The building sits on 5.2 acres of land.

“We loved the history of the old building,” Matthews says. “We wanted to bring that back to life and improve the whole area.”

Centurion Development Group is busy with two big projects. The company is giving the 670,000-square-foot Statler Hilton Hotel on Commerce Street a $175 million transformation. It’s also converting the adjacent former Dallas Central Library at Commerce and Harwood streets into mixed-use space.

Over at 1401 Elm St., the former First National Bank tower, which takes up an entire city block, is being converted into 480 luxury residential rental apartments and 150,000 square feet of destination-style retail space. It’s slated to open in 2017. The project, a $250 million joint venture between Olympic Property Partners and BDRC Partners, revitalizes the 1.5 million-square-foot, 52-story tower, which has sat empty since 2010.

Retailers are showing strong interest in the space, says Gosnell, who has secured early commitments from a number of tenants. “It’s a large space to deliver and it’s the first project in downtown that I’ve been able to get that kind of front-end stimulation on,” he says.

MAIN STREET MOGUL

About 8,200 people now live in the core of downtown Dallas. (The city’s 15 downtown districts, which include Uptown, are home to a total of about 40,000 people.) Occupancy of residential space in the core is at 93 percent. That has lured multifamily developers, which have a total of 3,150 apartments and lofts under construction. In turn, the higher residential density is attracting much-needed retailers.

Capitalizing on and helping to drive the trend has been Headington Cos., which has redeveloped a number of properties along Main Street. Led by the elusive Tim Headington, who has had tremendous success in the oil and gas and entertainment industries, Headington Cos.’ transformative projects include The Joule, a 164-room luxury hotel at 1530 Main Street. The Gothic building was initially developed in 1927 as office space for Dallas National Bank. Headington is now at work on the new Forty Five Ten boutique across the street.

Gosnell calls the project a “game-changer.” The broker has been peddling downtown space for years, and for most of that time, he says few retailers were interested. Now, though, “every retailer you can imagine has been in the car trying to figure it out—big boxes, fashion, clothing, groceries—we’ve had them all touring trying to figure out where the play is,” he says.

With the swarm of redevelopment projects underway, the inventory of old Class B and C office buildings is pretty much depleted in the core. For Gosnell and other longtime urban boosters, it’s a great problem to have.

“What’s wonderful is a lot of them were terrific buildings,” Gosnell says. “They had some redeeming characteristics and because of TIF and federal money in the form of investment tax credit money those got redeveloped and saved. The historic fabric has been saved.”

SUBURBAN PLAYS TO WATCH

Dallas is a newer U.S. city, with most of its older buildings located in the urban core. So, that’s where most of the redevelopment activity is taking place. Industry observers expect to see more projects spring up in the West End of downtown and the Design District. But a couple of big projects are percolating in the suburbs, too:

DALLAS MIDTOWN: Scott Beck has ambitious plans for a $4 billion redevelopment on a 430-acre site anchored by Valley View mall, which he acquired in 2012. The venture will ultimately add millions of square feet of retail, residential, hotel, and offi ce space. The 430-acre Midtown district is bounded by Interstate 635, Preston Road, Alpha Road, and the Dallas North Tollway.

TEXAS STADIUM: The 78-acre site in Irving is within a triangle created by State Highways 114, 183, and Loop 12. It has sat vacant since the former home to the Dallas Cowboys was razed in 2010. San Diego-based OliverMcMillan was granted a memo of understanding concerning development of the Irving property, but that agreement has since expired. American Airlines was bandied about as a potential headquarters tenant, but those discussions have died down, too. Irving offi cials are eager to secure a project similar to CityLine on the site. The massive mixed-use development in Richardson is anchored by major operations for State Farm and Raytheon.

This feature by Karen Nielsen is part of an in-depth package on redevelopment and renovations that appears in the Summer 2015 edition of the Dallas-Fort Worth Real Estate Review, quarterly magazines produced by D for the Dallas Regional Chamber and The Real Estate Council. To read the full report (which includes a breakdown of 15 downtown projects and profiles of 400 Record, The Crescent, the Statler Hilton, One Dallas Center, 717 Harwood, and Solana), click here.